The government has increased the profit rate on national saving schemes by up to 1%.

The Central Directorate of National Savings (CDNS), which operates under the Ministry of Finance, has declared a rise in the rates of interest on some National Savings schemes, effective from May 9, 2023.

The purpose is to increase the schemes’ appeal and to promote public investment.

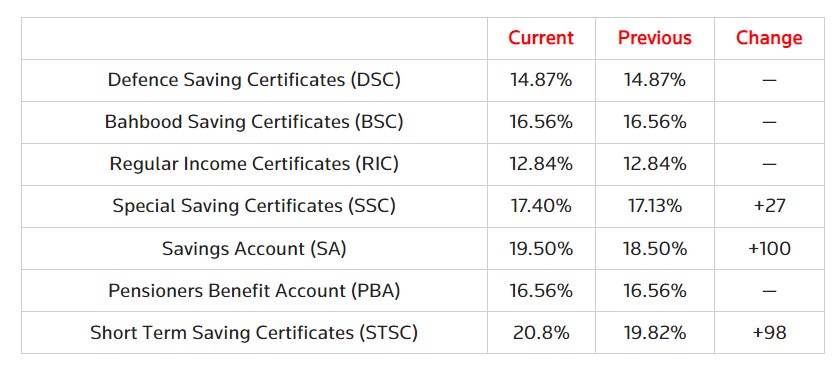

Hamid Raza Khalid, the director general of CDNS, tweeted about the adjustments and stated that the savings account rate has increased from 18.5% to 19.5%.

Additionally, the CDNS updated the rates for a number of savings plans.

The yield on Special Savings Certificates has increased to 17.4% from the prior rate of 17.13%.

The yield on the six-month Short-Term Savings Certificates (STSC) has increased to 20.82%, while the three-month STSC will now provide rates of 20.84%.

The rates for a 1-year STSC have also increased to 20.8%.

Khalid affirmed that the rates for the other schemes would not change.

Also Read: Restriction On Duty-Free Vehicle Imports To Foreign Tourists In Pakistan

The State Bank of Pakistan decided to boost the benchmark interest rate by 100 basis points to 21% last month.

The decision to combat persistent inflation will remain high in the near future leading to an increase in the rates of National Savings Schemes.

The CDNS offers saving certificates to individual investors and then reinvests the funds in government securities like Pakistan Investment Bonds (PIBs) and Treasury Bills (T-bills).

Also Read: Arab League Readmits Syria Into Its Fold To Support Bashar Al-Assad’s Govt