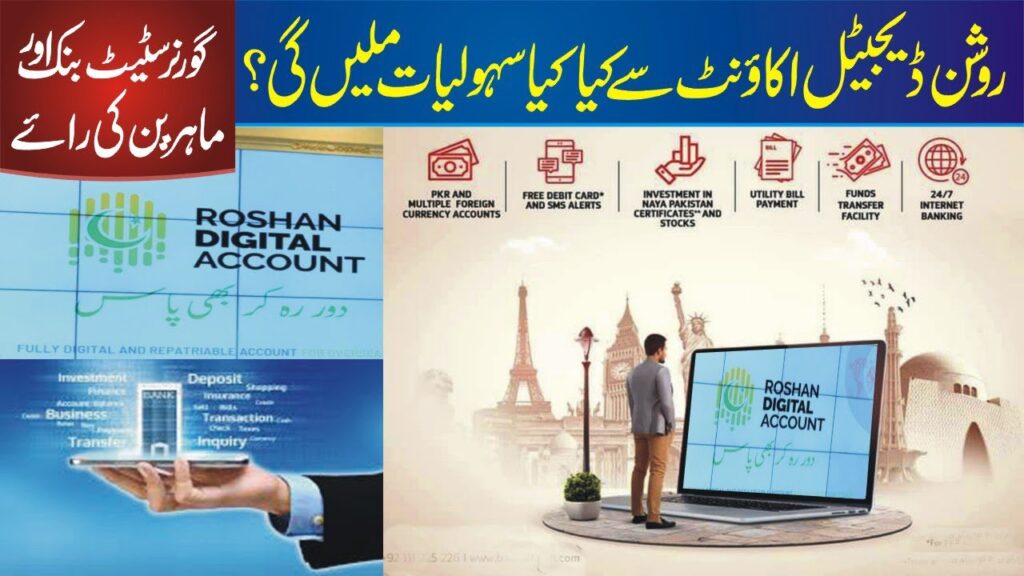

KARACHI: The Roshan Digital Account (RDA) has started picking up pace as it has crossed $800 million in six months, with the highest amount of $212m received in March, reflecting the rising trend of inflows.

“A big thanks to our Overseas Pakistanis! #RoshanDigitalAccount deposits have crossed $800m, after an inflow of $212m in March. Inflows have been accelerating every month since the RDA launch in September 2020,” the State Bank of Pakistan (SBP) tweeted on Thursday, as the total RDA deposits have reached $806m.

At 6%, the rate of return on dollars is very high, rather exorbitantly high, that created an extra attraction for the dollar holders.

A big thanks to our Overseas Pakistanis! #RoshanDigitalAccount deposits have crossed $800mn, after an inflow of $212mn in March. Inflows have been accelerating every month since the RDA launch in September 2020. To learn more about RDA, visit https://t.co/VFN8sp3BBY pic.twitter.com/GyNnATKilp

— SBP (@StateBank_Pak) April 1, 2021

The Roshan Digital Account — a joint effort of the SBP and federal government — was inaugurated by Prime Minister Imran Khan in September. More than 20 commercial banks have so far joined the RDA.

According to bankers, the main purpose of RDA is to attract millions of Pakistanis living abroad by offering much higher returns on deposits than those in developed economies.

The State Bank said that RDA attracted $212m in March, the highest since the launch of the product. In February, it attracted $176m.

The State Bank said the $806m inflows came from over 100 countries in 110,000 accounts.

The government and SBP believe that the RDA has much higher potential as it offers a number of facilities to overseas Pakistanis which were not available before. At the same time, banking in Pakistan for expatriates has been made easy and safe.

In order to attract more investment, the State Bank has also launched a savings scheme — Naya Pakistan Certificate — offering significantly higher interest rates compared to those prevailing in most of the developed and developing economies. Buyers can own the certificate in US dollar with the highest interest rate of seven per cent and in the local currency with 11pc per annum provided the investment is made for five years.

Some bankers said that most of the investments were coming into the Naya Pakistan Certificate, but the State Bank has not provided its data yet.

Higher interest rate is the biggest attraction for investors who have large liquidity but limited options in the global market. The increasing inflows of foreign investment in the domestic bonds (Pakistan Investment Bonds) and the offer of over $5.3 billion for euro bonds launched by Pakistan this week reflect the large available liquidity for investments in the global market battered by the Covid-19 pandemic.