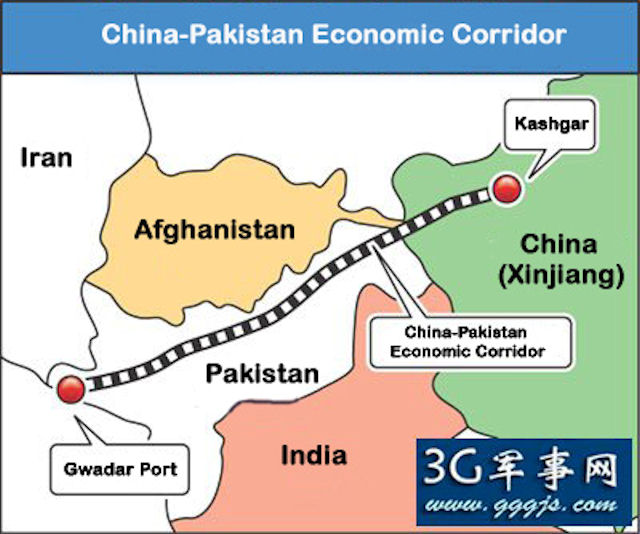

ISLAMABAD: Pakistan and China are likely to sign a bilateral framework agreement on industrial cooperation under the China-Pakistan Economic Corridor (CPEC) even though Islamabad has declined negotiated divestment of Pakistan Steel Mills (PSM) to Chinese firms.

Informed sources said a Chinese delegation has been engaging with Pakistan authorities for a government-to-government (G2G) deal on the country’s largest industrial complex which shutdown operations in June 2015.

In this regard, Federal Minister for Finance and Revenue, Industries and Production Muhammad Hammad Azhar presided over a meeting on economic and industrial cooperation under CPEC to address outstanding issues. The sale of PSM to Chinese state-run firms under the G2G arrangement also came up for discussions.

The sources told media that during the meeting, also attended by privatisation minister and secretaries of finance and privatisation, authorities explained to the Chinese side that G2G arrangement on PSM was not possible under the country’s privatisation law and the entity was now on top of the divestment list and at an advance stage.

Beijing aiming for G2G deal on Pakistan Steel Mills

Sources said the Framework Agreement on Industrial Cooperation was earlier expected to be signed during the Joint Cooperation Committee of the meeting tentatively scheduled in the last week of March.

An official statement said Federal Minister for Privatisation Muhammadmian Soomro, CPEC Authority Chairman Lt Gen Retd Asim Saleem Bajwa, Chinese Ambassador in Islamabad Nong Rong and Federal Secretaries for Finance and Privatisation Commission attended the meeting.

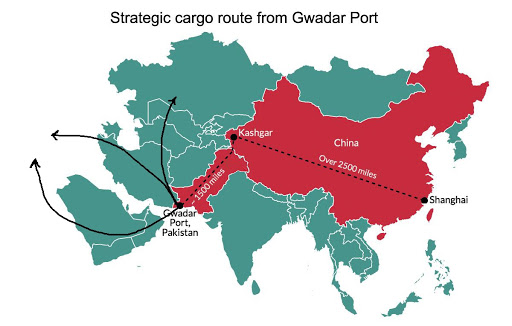

Mr Hammad said that CPEC was of “utmost importance for Pakistan” as it would enhance industrial production, upgrade energy and communication infrastructure and improve connectivity with the region. CPEC would generate abundant employment and investment opportunities in Pakistan and beyond, he added.

The Chinese ambassador, who led the delegation, also agreed that CPEC was “of immense importance for the Chinese companies” and will expand and strengthen economic cooperation for achieving common objectives and guarantee a prosperous future for both the nations.

The finance minister “stressed the need for the early completion of projects falling under the umbrella of CPEC” and noted that “time was of essence in meeting project deadlines so that the economic benefits could reach to the people of both the countries and contribute towards overall economic growth and development”.

Emerging profitable Concerns?

Last year, the government had decided to sack 100 per cent of about 9,350 employees to facilitate the privatisation of PSM. According to an old summary of the Ministry of Industries and Production, the “failure of the country’s mother industry was an unending story of unchecked corruption, inefficiency, and over-employment”.

The Pak-China Investment Bank had declared in 2015 that with an initial investment of $289m (about Rs29 billion), provision of uninterrupted electricity supply and a new management, Pakistan Steel had the potential of becoming a profitable enterprise given its ideal location, market and facilities.

The country’s largest industrial complex could generate the funds required for expanding its production capacity to three million tonnes, the bank said. It further proposed a development and expansion plan with a capital investment of $288.77m in the first phase, $300.4m in the second and $296.62m in the third phase. The total investment required was $885.8m, or approximately Rs100bn.

On the basis of field surveys, extensive data and in-depth discussions, the financial advisers had concluded that the PSM was a steel enterprise which had a high starting point, complete process chain and the advantages of resource acquisition and regional market.

The advisers were of the opinion that because it was located near a coastal city with over 20m population and close to the 50,000-tonne bulk cargo wharf relying on raw material and fuels import, the PSM owned rare logistic cost advantages. With the expansion of its production capacity in future, its harbour could also be used to ship products to the rest of the market.

(@Brig_Munir)

(@Brig_Munir)