Pakistan’s central bank is expected to maintain its record-high key interest rate of 22% during Monday’s policy meeting, marking the seventh consecutive meeting without a change. This decision aligns with Pakistan’s preparations for IMF board approval and discussions regarding a longer-term program.

Following Monday’s policy decision, the IMF’s executive board will convene to consider the approval of $1.1 billion in funding for Pakistan, representing the final portion of a $3 billion standby arrangement secured last summer to prevent a sovereign default.

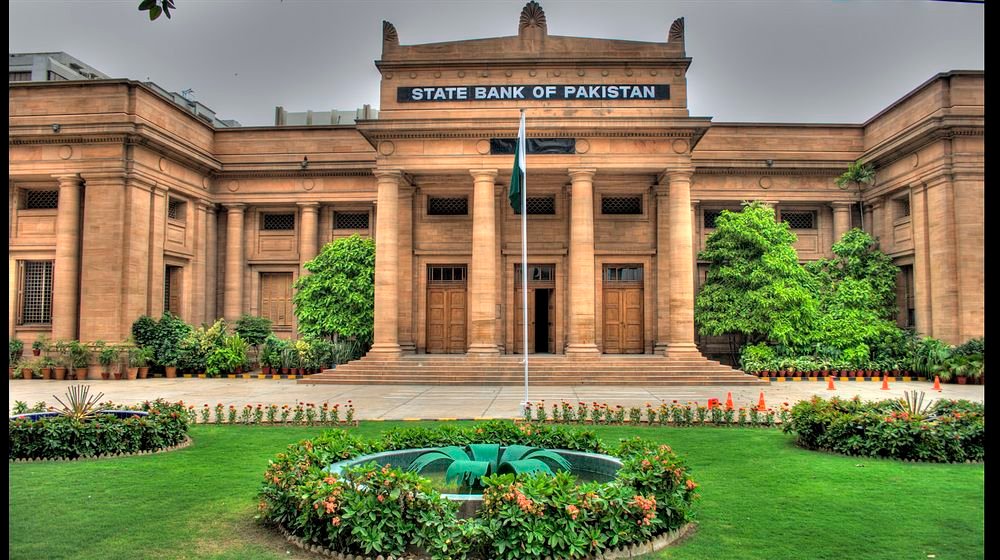

According to a Reuters poll of 14 analysts, the median estimate suggests the State Bank of Pakistan (SBP) will keep rates unchanged. However, four analysts anticipate a 100-basis-point reduction, while two expect a 50-basis-point cut.

Eight respondents predict a rate cut before Pakistan finalizes a new program with the IMF. The next MPC meeting is scheduled for June 10, 2024, possibly preceding Pakistan’s acquisition of another IMF program.

Pakistan aims to secure a new, more extensive IMF loan. Finance Minister Muhammad Aurangzeb has indicated that Islamabad will commence discussions with the IMF next month and could reach a staff-level agreement on the new program by early July.

The last increase in Pakistan’s key rate occurred in June, intended to counter persistent inflationary pressures and fulfill one of the conditions stipulated by the IMF for the bailout.

In March, Pakistan’s Consumer Price Index (CPI) increased by 20.7% year-on-year, showing a slowdown partly attributed to the “base effect,” following a record high of 38% in May 2023.

Tahir Abbas, head of research at Arif Habib Limited, suggests that the central bank is unlikely to reduce rates before securing a new IMF program. He emphasizes that monetary policy considerations will also encompass inflationary impacts stemming from Middle East tensions and fluctuations in fuel prices, alongside the Federal Reserve’s postponement of monetary easing.

Mustafa Pasha, Chief Investment Officer of Lakson Investments, anticipates a symbolic rate reduction in the current quarter, followed by more aggressive cuts in the September quarter. He highlights the necessity for these cuts due to the government’s need to roll over approximately 6.7 trillion rupees of maturing domestic treasury bills in the last quarter of the calendar year. Pasha expects the policy rate to stabilize around 17% by December, noting historical trends of rate cuts in the first year of an IMF program.