ISLAMABAD: From June 1, 2021, YouTubers, living outside the United States, will have to pay tax to the American government according to the US tax laws. For this purpose YouTube has updated its terms and conditions which have been conveyed to the YouTubers a couple of days ago.

According to the new terms and conditions of YouTube, payments of all royalties to the YouTubers throughout the world will be treated as royalties from the American tax perspective from June 1, 2021. Hence, Google will withhold tax as per the US income tax laws from the non-American YouTubers, earning money from YouTube from anywhere in the world. And this tax money will be handed over to the US government. YouTube has further pointed out that the YouTube creators, living outside the United States, are entitled to revenue payments which will be subjected to tax deduction with effect from June 2021 as per the US tax laws.

At present, the federal income tax regime of the United States involves 7 different tax slabs. The first and the lowest income tax rate starts from 10 percent while the highest income tax bracket ends at 37 percent of the income of individuals and organizations. Thus, deduction of tax from income of non-US resident YouTube Video Creators will depend on the quantum of their income from this social media platform. Therefore, millions of people earning money from YouTube must be ready to face a tax deduction from June 2021. Worth noting is that in Nov 2020, YouTube revised its terms and conditions for its users, but did not announce the date of deduction of tax at that time.

Similarly, in its new terms and conditions, YouTube has also made it mandatory for the YouTubers to follow its facial recognition rules and not publish videos, other content involving people without their consent. In other words, from June 2021, YouTubers’ sting operations and secret video recording will be discouraged under the facial recognition policy of this social media network.

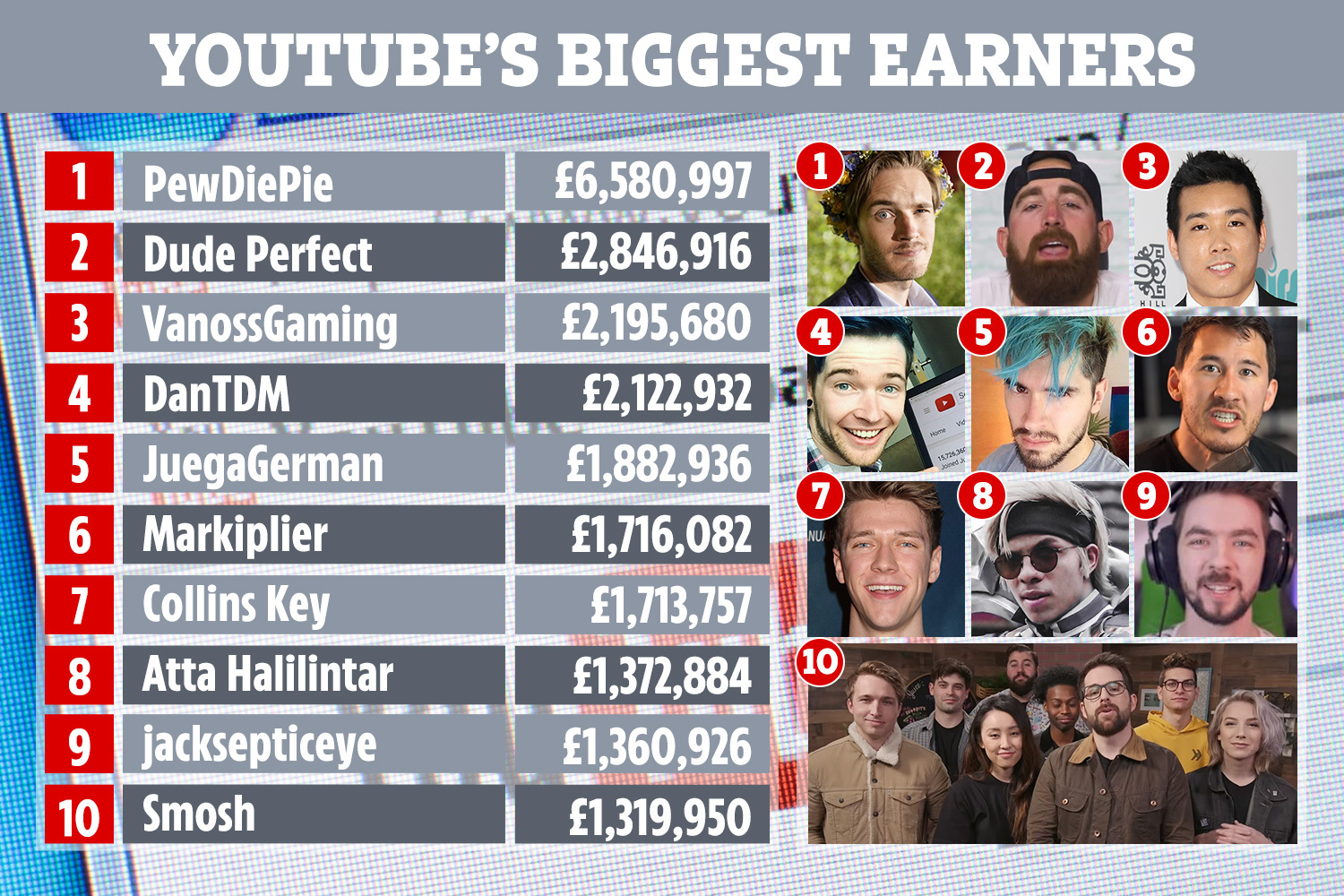

Furthermore, YouTube has also explained that it has the right to monetize all the videos and other content being uploaded on its platform. Elaborating it further, YouTube said that it can display commercial advertisements from channels which may not be part of the YouTube Partner Programme. Importantly, millions of people across the world are earning money from YouTube by uploading videos. However, they are not being subjected to the payment of tax according to the US laws. The new policy of YouTube seems to be an attempt of the United States government to generate a substantial amount of money as tax on payment of royalties to YouTubers from June 2021. YouTube, nonetheless, has made it clear that there is no change in its policy which allows easy access to YouTube users and content producers.

Meanwhile, new YouTube users, who want to monetize their content must know that they will have to fulfill two essential requirements of YouTube to earn money. First, each YouTuber must have a minimum of one thousand subscribers. Second, every new YouTube Creators will have to generate 4000 watch hours of their videos to qualify for monetization in a year’s period. Without completing these two core tasks, YouTubers cannot qualify for monetization policy of this social media platform. Also, content of videos must be original or reproduced in a manner which does not violate the copyright laws of YouTube.