In recent years, Beijing has come under fire for the way it lends to developing nations, with the accusation that it leaves these countries vulnerable and unable to pay back their loans. Is China piling up debt that cannot be paid back? Is it burdening the developing nations with debts?

Faced with such queries, China claims that the West is propagating this narrative against it to harm its reputation. As per them, taking money from China has not resulted in any country falling into the so-called “debt trap.”

China’s Lending Practices

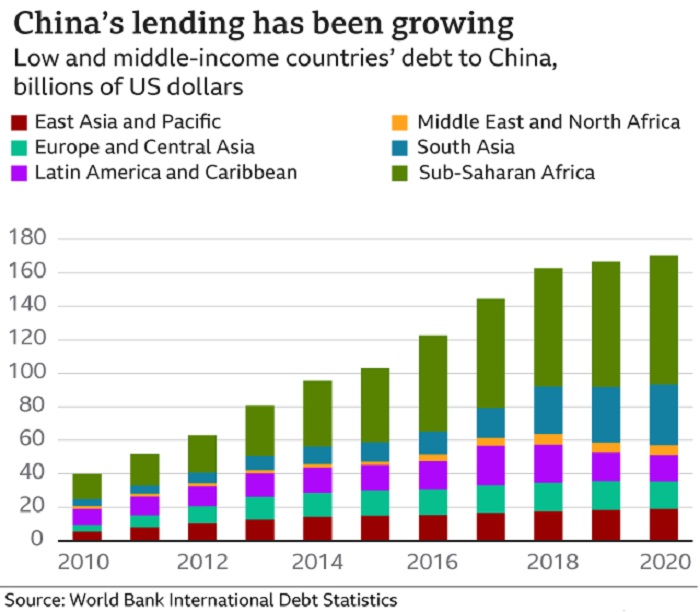

When it comes to global debt, China is one of the world’s largest single lenders. Over the previous decade, it has quadrupled its loans to lower and middle-income nations, reaching $170 billion (£125 billion) by the end of 2020. China’s entire lending commitments, on the other hand, are likely to be far higher than these numbers.

More than half of China’s loans to developing nations go unreported in official debt data, according to Aid Data, an international development organisation at William and Mary University.

Instead of the government, state-owned corporations and banks, joint ventures, or private entities are frequently used as money conduits.

According to Aid Data, there are currently more than 40 low- and middle-income countries with debt exposure to Chinese lenders of more than 10 per cent of their annual economic output (GDP) because of this “hidden debt.”

Djibouti, Laos, Zambia, and Kyrgyzstan owe a debt to China that is equivalent to at least 20% of their annual GDP.

The Belt and Road Initiative of Chinese President Xi Jinping has also resulted in a major portion of the debt owed to China in the mining and energy sectors. It’s important to understand what a “debt trap” is and how it works. China is an influential lending country, extending huge debts to developing nations, most of which cannot be paid back. Based on these burdensome debts, China is increasing its political leverage on weaker states.

British MI6 chief Richard Moore claimed to the BBC that China uses “debt traps” to acquire power over other countries.

Be wary of Chinese “debt traps”

It is claimed that foreign nations are forced to hand over critical assets to China if they cannot comply with their loan repayments, a charge that has long been refuted by the Chinese authorities.

Critics of China frequently point to Sri Lanka’s enormous port project in Hambantota, which was funded by Chinese investment several years ago. Sri Lanka is now drowning in debt as a result of a $1 billion project that relied on Chinese funds and contractors. But the project was troubled by scandal and protests. Then a deal was struck in 2017 between Sri Lanka and state-owned Chinese merchants to grant the merchants a controlling 70% ownership in the port on a 99-year lease.

UK-based think tank Chatham House has raised doubts about the “debt trap” narrative in the Siri Lankan port scenario, given that the agreement was motivated by local political considerations and that China never officially owned the port. As per them, most of Sri Lanka’s debt is owed to non-Chinese lenders and that China has not leveraged the port location to obtain a military strategic advantage.

However, there is little question that China’s economic involvement in Sri Lanka has increased significantly over the past decade, and fears linger that this may be exploited to further China’s political aspirations in the area.

So, Chinese loans have also been problematic as contracts with clauses that might give China influence over major assets have caused controversy in other regions of the world.

Is China a Loan Shark?

Among the hundreds of loan agreements examined by Aid Data and other research organizations, no incidents of Chinese state-owned lenders taking a large asset in the event of a loan default have been found.

Most of China’s contracts have non-disclosure clauses, which ban borrowers from disclosing the terms of their loans. International loan contracts are common for such secrecy.

Confidentiality clauses are widespread in international commercial loans, according to Queen Mary University of London Professor Lee Jones. He also claims that most Chinese development finance is based on profit motives.

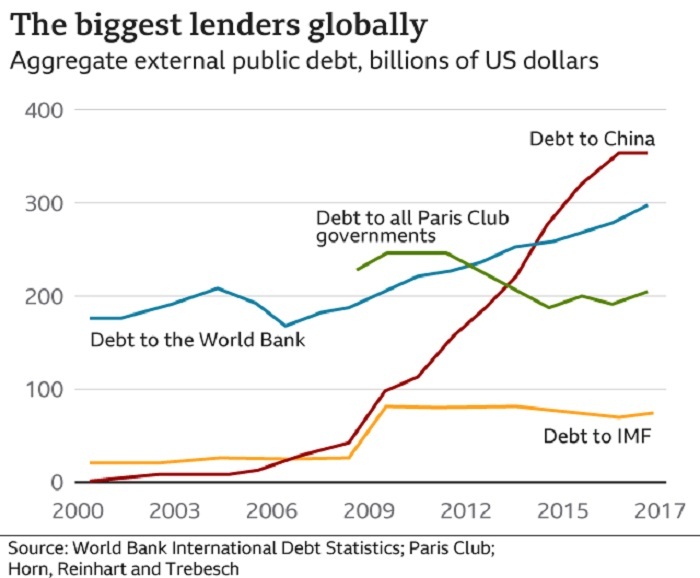

The Paris Club is a group of major industrialised nations that share information on their loan activities. Despite China’s decision not to join this organisation, data from the World Bank shows that China’s reported lending services have grown far faster than those of other countries.

China is known to lend at a greater interest rate than other countries, particularly the west. At nearly four times as much as a normal World Bank or individual nation loan, these loans have interest rates comparable to those of the commercial sector. The Chinese loan payback duration is also lower than other lenders’ concessional loans to developing countries—less than 10 years, compared to roughly 28 years for other lenders’ loans.

Lenders in China also require borrowers to maintain a minimum cash balance in an overseas account that the lender has access to. An executive director at Aid Data reports China may simply deduct cash from that off-shore account if a borrower does not pay back its obligation, rather than having to go to court to collect on bad debt. Loans from western lenders rarely use this strategy.

As a response to the epidemic, the G20 countries—those with the largest and fastest-growing economies—have announced a plan to grant debt relief to poorer countries. China has joined this and has contributed the “largest amount of debt repayment” among the participating countries.

The World Bank estimates that G20 nations have given more than $10.3 billion in debt relief since May 2020. But World Bank could not provide a breakdown by country.

Works at The Truth International Magazine. My area of interest includes international relations, peace & conflict studies, qualitative & quantitative research in social sciences, and world politics. Reach@ [email protected]