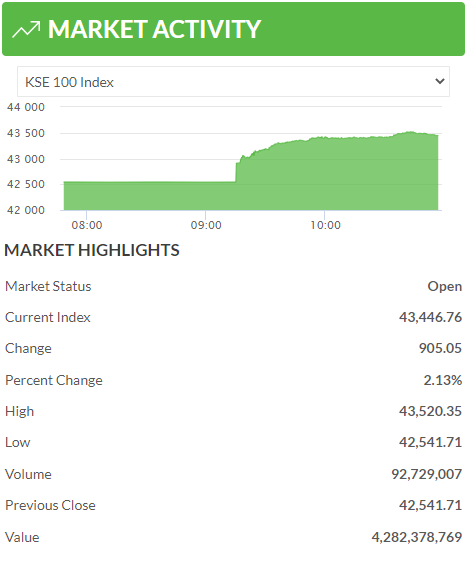

ISLAMABAD: Pakistan Stock Exchange (PSX) benchmark KSE-100 index gained over 900 points on Friday morning, at 11am while dollar lost over Rs 3 in the interbank and fell to 200 rupees, from earlier price of Rs202.10 in the inter-bank.

The government’s decision to increase domestic petroleum prices has paved the way for the resumption of the stalled IMF programme. Consequently, the stock market and rupee have recorded a significant gain in just one day (Friday/May 27). The KSE-100 index has surged to 43,404 points.

It is understood that this huge increase in domestic petroleum prices would trigger a new wave of price-hike in the country, but the decision will gradually stabilize the deteriorating economic situation in the country, which is evident from recovery in the stock market and value of rupee. In April 2022 the new government has requested IMF to enhance the quantum of the loan to $8 billion, from existing $6 billion. Another advantage of the IMF loan approval is that the friendly countries like Saudi Arabia, China, UAE and others would also provide financial assistance to Pakistan. Also, the country will be able to offer for sale bonds in the international market to mop up foreign exchange conveniently and at an affordable rate of return. According to Finance Minister Miftah Ismail, in 2022-23 Pakistan will have to pay back $21 billion foreign loans and this would be possible only with the support of the IMF and friendly countries.

Since the formation of allied government led by PML-N, the US dollar has gained more than 17 rupees value in the inter-bank trading and it crossed Rs202 on Thursday (May 26) before falling to Rs200 on May 27, a day after hike in domestic petroleum prices.