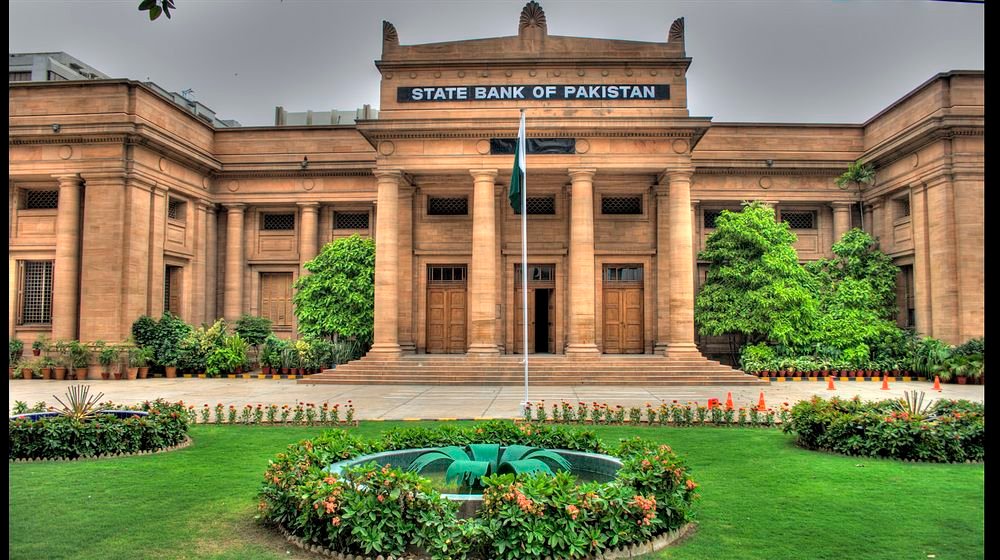

The State Bank of Pakistan (SBP) has announced that it will convene a meeting of its Monetary Policy Committee on March 2, two weeks ahead of its previously scheduled date. The central bank is expected to increase the main policy rate during this meeting to meet IMF requirements.

SBP prepones monetary policy meeting

In a brief statement, the SBP said, “The forthcoming meeting of the Monetary Policy Committee has been preponed and now it will be held on Thursday, March 02, 2023.” Off-cycle rate reviews are not unusual.

The forthcoming meeting of the Monetary Policy Committee has been preponed and now it will be held on Thursday, March 02, 2023. pic.twitter.com/555JOhCFoe

— SBP (@StateBank_Pak) February 28, 2023

Pakistan is taking crucial measures to secure funding from the International Monetary Fund (IMF). These measures include raising taxes, removing blanket subsidies, and lifting artificial curbs on the exchange rate. Although the government anticipates reaching an agreement with the IMF soon, media reports suggest that the agency also expects the policy rate to be raised.

Market participants who recently participated in a treasury bill auction are expecting at least a 200 basis points increase in the policy rate, which currently stands at 17 percent. This anticipated increase is based on the rates the government set in the auction to raise funds.

The SBP’s Monetary Policy Committee meeting will take place amidst a challenging economic landscape. Pakistan has been grappling with inflation, a widening current account deficit, and slow economic growth. The country is currently facing a balance-of-payments crisis and needs external financing to stabilize its economy.

SBP’s Measures to curb inflation

The SBP has been taking steps to curb inflation, such as increasing interest rates, tightening monetary policy, and imposing import restrictions. The central bank has also allowed the rupee to depreciate against the dollar in an attempt to boost exports and narrow the current account deficit.

concerns of Pakistan’s business community

Pakistan’s business community has expressed concern about the impact of the anticipated policy rate increase on their operations. They have called on the government and the SBP to take measures to alleviate the burden of higher borrowing costs.

The SBP’s decision to hold an off-cycle Monetary Policy Committee meeting signals its determination to address the country’s economic challenges. The central bank’s actions will be closely watched by investors, businesses, and the public, as they will have a significant impact on the country’s economic outlook.

Additionally, the government of Pakistan generated Rs258 billion in an auction held on February 22, 2023. The cut-off rates for three-month, six-month, and 12-month tenors increased significantly, reaching 195 basis points, 206 basis points, and 184 basis points higher than the previous auction.

The State Bank of Pakistan (SBP) has raised interest rates by 725 basis points since January 2022, with the latest increase of 100 basis points taking effect in January 2023. The SBP’s decision to raise rates was primarily aimed at curbing the skyrocketing inflation rate in the country.

However, despite the rate hikes, the inflation rate continued to climb. January 2023 saw the highest annual inflation rate in over 50 years, at 27.5 percent.

The recent increases in gas tariffs led experts to believe that the Consumer Price Index may surge to nearly 30 percent in February.

The SBP’s actions received mixed reactions. Some experts commended the bank’s efforts to address inflation. While others criticized the rate hikes for potentially stalling economic growth. Despite this, the government remains committed to its efforts to stabilize the economy and control inflation.

Read more: Austerity Committee directs ministries to implement 15% cut in current budgets