WASHINGTON: The International Monetary Fund (IMF) in its board meeting on Wednesday gave the green signal for the release of $1 billion to Pakistan under the extended fund facility (EFF).

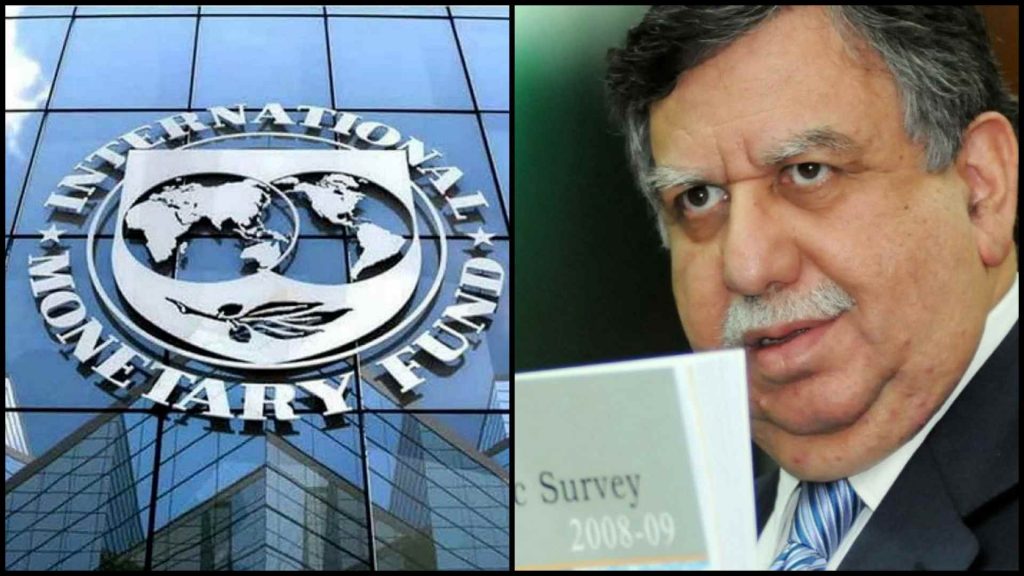

As the currency market was rife with speculations about the approval since the start of the week, the Pakistani Rupee appreciated by 0.03% against the greenback. Finance Minister Shaukat Tarin rejoiced at the approval saying, “I am pleased to announce that IMF Board has approved 6th tranche of their program for Pakistan.”

I am pleased to announce that IMF Board has approved 6th traunche of their programme for Pakistan.

— Shaukat Tarin (@shaukat_tarin) February 2, 2022

With the latest tranche of $1bn, the total disbursements to Pakistan will reach $3.02bn which is 106 pc of the country’s total.

This comes against the backdrop of twice postponed 6th review board meetings – scheduled for Jan 12 and Jan 28 – at the request of Pakistan as the government struggled to meet the tough conditions put forward by the Fund.

Earlier, the IMF program was stalled due to a deadlock in talks which prompted Finance Minister (Finance Advisor at the time) Shaukat Tarin to visit Washington to persuade the IMF Board for resumption of the loan facility.

The finance supplementary bill, more commonly known as the ‘mini-budget’ was shrouded in controversy as opposition benches in the parliament considered it a surrender to the IMF which would have grave consequences for the financial sovereignty of the country.

Similar concerns were raised by the opposition against the State Bank of Pakistan (Amendment) Bill 2021 as they believed the bill would make State Bank unanswerable to the parliament.

Through the mini-budget, the government withdrew subsidies and tax concessions worth Rs 343bn, in its pursuit to convince IMF to release the remaining amount of the loan. In November, Tarin had said: “To qualify for the tranche, the Public Sector Development Program was cut by Rs200 billion or 22 percent and the “contingency grants” were reduced by Rs50 billion.”

The EFF arrangement negotiated in July 2019 paved the way for Pakistan to receive SDR 4.268bn (approx. $6bn) over a 39-month period.

IMF’s extended fund facility is designed to assist countries facing serious balance of payment crises that could potentially make them defaulters. To avoid the worst-case scenario, governments seek the fund’s assistance and enter into a medium to a long-term program that would allow them ample time to remedy structural weaknesses. During this period, IMF imposes certain conditions on the recipient country on the basis of which it releases subsequent tranches of the total sum of loan initially negotiated.

Since the total sum is not released at once, the IMF gains considerable influence on the recipient country’s economy till the program lasts. Another reason for knocking on the doors of the Fund is those other donor agencies for e.g., Asian Development Bank (ADB) and World Bank only offer loans if the IMF program is successfully progressing.

The author covers politics and foreign affairs for Truth International Magazine. He can be reached at [email protected] or at https://twitter.com/shahmir_niazi