Pakistan and Afghanistan share deep historic, religious, cultural, civilizational, and ethnic bonds. But probably the most important of the two countries’ linkages is the bond of neighbourhood. The two countries have remained in close physical proximity for millennia – and will remain that way in the foreseeable future barring a cosmic accident.

As would be expected, this close proximity has its perks as well as its pains. Here is a look at the costs and benefits of being Afghanistan’s closest neighbour in terms of economy.

Afghanistan at a glance

Population of Afghanistan is less than 4 crore or 38.93 million exactly by 2020. Its GDP size is USD 19.81 billion (nominal, 2021 estimated) or USD 78.88 billion (purchasing power parity = PPP, 2019 estimated) and the GDP per capita (PPP) is about USD 2,000. In its overall GDP, the contribution of agriculture is 23 percent, industry is 21.1 percent, and services 55.9 percent.

The refugee factor

Refugees’ dependence is likely to grow on Pakistan from Afghanistan and not likely to reduce in anyway. Going by the UNHCR refugee register, there are 1.4 million Afghan Refugees in Pakistan. However, their total number comes closer to 3 million, the majority of them unregistered with UNHCR.

There are around 6,000 Afghan studying in universities and colleges in Pakistan with 500,000 refugee students enrolled in schools in Pakistan. There are 2,000 fully funded scholarships for higher education in Pakistan.

Foreign trade

It imports over USD 6 billion worth of goods but legally exports about USD 1 billion worth of produce, mainly fruits and nuts. Despite holding over USD 1 trillion in proven untapped mineral deposits, Afghanistan remains one of the least developed countries in the world. Its unemployment rate is over 23 percent and about half of its population lives below the poverty line.

Bilateral trade

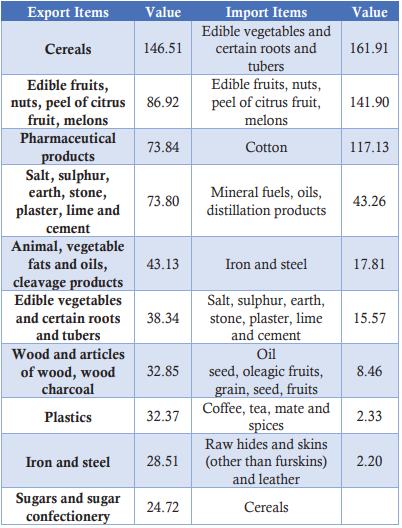

The two countries have substantial trade linkages. Pakistan used to be Afghanistan’s largest trade partner but now India and Iran are their largest trading partners. The declining volume of Pakistani exports to Afghanistan is not only depriving the country of a major market for its products but also giving local exporters sleepless nights.

Data released by the State Bank of Pakistan (SBP) showed that Pakistan’s exports to Afghanistan fell 5.5 percent from USD 790 million to USD 746.3 million during the first nine months of the current fiscal year. While sugar, petroleum products, wheat and rice are the top exports to Afghanistan, Pakistan imports grapes, apples, coal, and cotton from Afghanistan.

Even after the advent of Taliban government, industry in Peshawar, like printing, pharmaceutical, flour, cement, steel and others, which were directly linked to Afghan consumers, had shrunk during last few years after heavy involvement of India with USA pressures. Now that is easing but that trade is still to take a regular shape, before it has to revert back to its past potential.

Forex drain

Net loss of US withdrawal from Afghanistan in daily dollar terms trade is around USD 6-8 million, which has now reversed as Afghan demand has returned to USD 2-3 million daily. This is being fulfilled from Pakistan dollar market with additional impact going up to USD 3 billion.

The inflow from Afghanistan to Pakistan was due to US forces demands. Moreover, US dollar demand of Afghanistan is being fulfilled from Pakistan now, creating a huge pressure on Pak rupee. This partly explains a significant depreciation of Pak rupee in last few weeks.

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Exports | 1699 | 1230 | 1134 | 1495 | 1193 | 890 |

| Imports | 37 | 41 | 68 | 152 | 170 | 122 |

| Trade Balance | 1662 | 1190 | 1066 | 1343 | 1022 | 768 |

Transit trade & smuggling

Afghan transit trade is the main source of smuggling into Pakistan. Besides causing annual revenue loss of up to USD 3 billion to the national exchequer, it is also promoting terrorism in the country as explosive devices and other material are also being smuggled through it, it has been revealed. A World Bank document says smuggling through Afghan transit trade alone caused USD 35 billion revenue loss in the period between 2001 and 2009.

Smuggling is now a routine in most of the economic activities in Pakistan. Pakistan is facing the enormous challenge of measuring and curbing revenue leakages due to smuggling, the report says. These leakages are estimated to be 50 to 60 percent of the regular economy. Cheaper products like cloths, fancy tiles, auto parts, electronics goods, crockery and other items are being smuggled into the country to the detriment of the local industry.

Pakistan and Afghanistan extended the ‘Afghanistan-Pakistan Transit Trade Agreement (APTTA) 2010’ for six months beyond 11 May 2021. The 2010 APTTA allows both countries to use each other’s airports, railways, roads and ports for transit trade along designated transit corridors.

The agreement does not cover road transport vehicles from any third country, be it from India or any Central Asian country. Over the last 10 years, 832,819 ATT containers, carrying goods worth USD 33 billion, passed through Pakistan, as per data compiled by the FBR Directorate General of Transit Trade.

Around 30 percent of Afghan Transit Trade passes through Pakistan.

Security implications

Pakistan continues to pay a heavy price both in the economic and security terms due to this situation and a substantial portion of precious national resources both human and material, have been diverted to address the emerging security challenges for the last several years.

The cumulative bearing of these developments adversely impacted the overall growth rate in many sectors of the local economy.

Security situation in Afghanistan effects our trade with Central Asian Republics and beyond. Pakistan exports to Afghanistan and CAR’s showed a mixed trend over time (For Reference Table-1 in Annex).

Uzbekistan’s Trade with Pakistan has been very erratic due to fluctuations in exports. In 2020, the trade deficit for Pakistan was USD 73 million as imports and exports stood at USD 97 and USD 24 million respectively.

Pakistan’s gateway to Central Asia

Pakistan is considered only (or at least the most economical) gateway to Central Asia. Trans-Afghan Railway Line Project was signed and agreed between Pakistan, Uzbekistan, and Afghanistan this year. It is hoped that Involvement with TIR (International Road Transport or Transports Internationaux Routiers) will unleash great potential for trade in Pakistan and from Pakistan.

The first-ever containerised shipment from Pakistan under TIR reached Tashkent in 48 hours from Torkham. It departed from Karachi on 29 April 2021 and arrived in Tashkent on 4 May 2021 via the Karachi-Kabul-Termez route.

An Uzbek cargo truck then took a shipment of leather products from Tashkent on 9 May and arrived at the Afghan-Pakistani border (Torkham crossing) on 11 May. Then the consignment was trucked to Faisalabad on 13 May.

As a result of TIR, the Afghan government will not check Pakistani trucks carrying goods to Central Asian countries.

The stalled CASA-1000 project is a 1,270 km (113 km in Pakistan) power transmission line that is expected to export excess hydropower generated in Kyrgyzstan and Tajikistan to Pakistan through Afghanistan.

Work on the construction of a transmission line in Afghanistan and Central Asian countries has been going on for almost a year now.

When completed, CASA-1000 will enable the supply of as much as 4,500 GWh of sustainable and clean electricity. Cost of the Pakistan’s component (113-km HVDC line and the convertor station) is USD 205 million.

Afghanistan’s mineral wealth

In Afghanistan, significant amount of resources includes minerals, oil, natural gas, marble, granite, sand, coal, lapis lazuli and gemstones. Currently the Aynak and Hajigak concessions in collaboration with the Chinese conglomerate China Metallurgical Group Corporation (MCC) is targeting mining industries with the potential of around USD 1 trillion earnings.

However, the social, economic, cultural and political situation of Afghanistan does not favour largescale extraction of minerals. There is scope for Pakistani registered mining Small and medium firms to capitalise the mining industries.

Farm produce

Pakistan is a major importer of Afghan fresh produce including vegetables and fruits; and dry fruits like almond, walnut, and chilghoza.

Another important aspect for Pakistan is Afghanistan’s wheat consumption requirement that is around 7 million tons annually. Wheat as staple food accounts for approximately 60 percent of the calories intake of the population.

Production of wheat in Afghanistan covers 70 percent of the cultivated land area to feed 39-40 million population. Pakistan supplies significant amount of wheat and pulses to Afghanistan to fill the demand-supply gap.