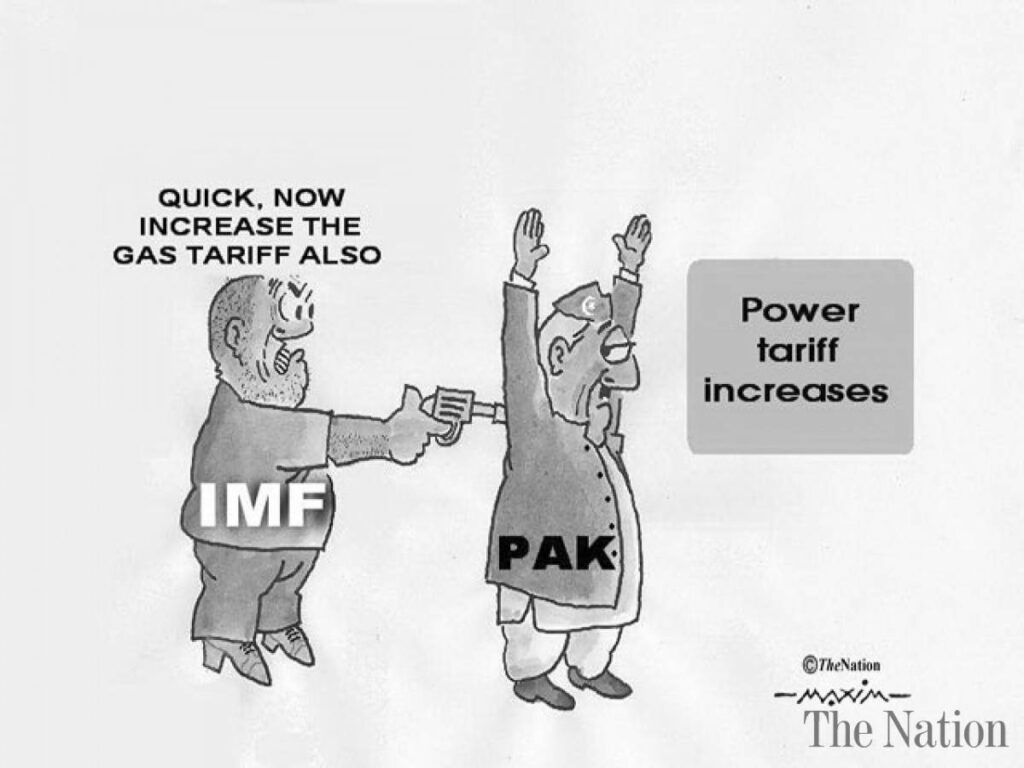

ISLAMABAD: Pakistan and the International Monetary Fund (IMF) are working to bridge their differences over few measures in the budget. Few are settled few are in process of settling, says a high up of Finance Ministry talking to TTI News.

There are quantum of new taxation measures amid the government’s willingness to increase sales tax rate on fertilizer to 10% and slap 17% tax on import of crude oil to generate Rs115 billion.

There is also a proposal to tax interest income under normal tax regime, instead of charging a maximum rate of 15% that is at the lower end.

The talks between the IMF and Pakistan will continue next week, although only five days are left in presentation of the budget for fiscal year 2021-22, said a source that is part of the negotiations.

The sources said that if the issues could not be settled at the level of Finance Minister Shaukat Tarin and IMF’s Mission Chief Ernesto Rigo, Prime Minister Imran Khan may talk to IMF Managing Director Christalina Georgieva next week.

Federal Information Minister Fawad Chaudhry said that “no telephonic conversation was planned today (Saturday)” between Imran Khan and Georgieva.

Another source said that the key difference between the two sides was the taxation measures that Pakistan has to take to achieve next fiscal year’s tax target of Rs5.829 trillion. Without additional taxation measures, Pakistan will reach Rs5.3 trillion and the IMF wants that the rest of the gap should be filled with additional revenue measures.

However, the government is of the view that the IMF should leave this to Pakistan whether the target will be achieved through taxation measures or administrative measures.

“Talks are moving and will be concluded within the scheduled time,” a senior Pakistan official replied when asked when both sides will be able to minimise the gap. The government has not completely ruled out the possibility of taking additional taxation measures and has shared some proposals with the IMF, said the sources. Among those proposals are taxation of fertiliser and crude oil.

The sources said that there was a proposal to increase the GST rate on fertiliser from 2% to 10% to generate Rs32 billion in revenues. The fertiliser companies had demanded the government to either zero rate its supplies of gas or increase output tax to 17% to avoid refunds.

The companies are claiming that their about Rs150 billion worth refunds are stuck in the Federal Board of Revenue (FBR). The manufacturers have also demanded clearing their tax refunds through a system that has been designed for exporters.

There is also a budget proposal to impose a 17% tax on import of crude oil. The measure will generate Rs85 billion revenues in the next fiscal year. There is already a tax at the local stage but the FBR suspects that one oil refinery evades taxes on its production of oil products.

However, taxation at the import stage may result in liquidity problems for the companies due to usual delays in repayment of refunds.

The sources said that the government was also considering bringing the interest income under normal tax regime that will generate a minimum Rs2 billion in the next fiscal year. The interest income is being taxed under three different regimes. For below Rs500,000 income the tax rate is 10% and for above Rs500,000, it is 15%.

The sources said that the industries minister has also proposed exempting investment in new industrial projects from disclosure of source of income. However, the proposal is likely to meet resistance from the FBR.

The government has already allowed exemption on disclosure of source of income on investment in the construction sector under real estate tax amnesty scheme. The scheme is going to expire by the end of this month and so far there is no final decision whether to extend it or not. The sources said that the Naya Pakistan Housing and Development Authority chairman had met with the FBR chairman to pursue him to extend the amnesty further.

The construction sector is the flagship project of the prime minister and he is betting on its revival for a surge in economic activities.

Details of Tax

The sources said that the government was also discussing with the IMF to allow it to treat collection under petroleum levy and profit of the central bank as part of the tax revenues without making these part of the divisible pool. The change of petroleum levy and SBP profit from “non-tax” to “tax” revenue would increase the tax-to-GDP ratio that so far remains dismally low.

The overall tax-to-GDP ratio has slipped to 11.4% of GDP by end of last fiscal year from 12.9% at the end of the PML-N tenure. The FBR’s tax-to-GDP ratio was hardly 9%.