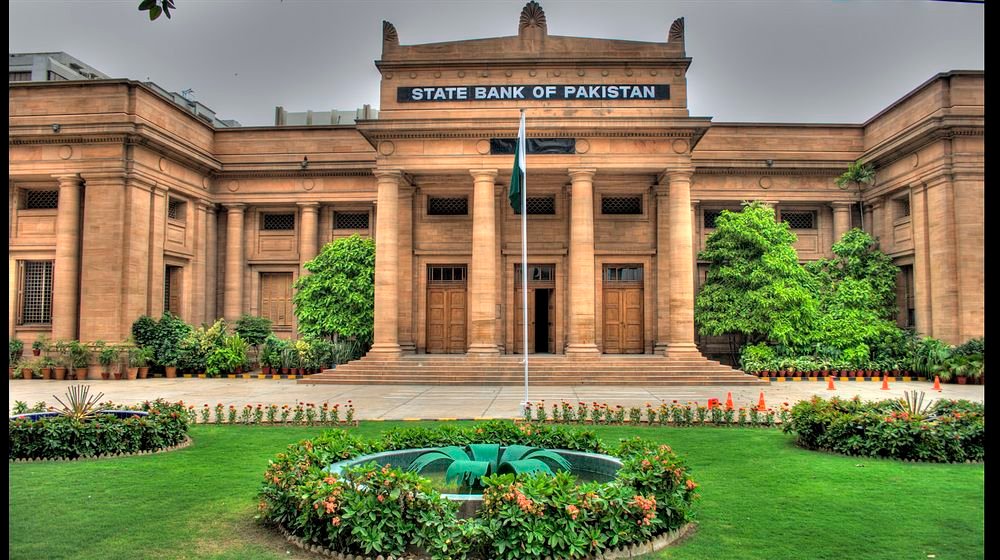

ISLAMABAD: After a nine-month hiatus, the State Bank of Pakistan (SBP) has seen its reserves grow to over $8 billion. This increase in reserves is attributed to financial assistance received from the International Monetary Fund (IMF), United Arab Emirates (UAE), and Saudi Arabia.

As of July 14, Pakistan’s total liquid foreign reserves stand at $14.06 billion. With $8.7 billion held by the SBP and $5.3 billion held by commercial banks.

The inflow of funds was significant, with $2 billion from Saudi Arabia, $1.2 billion from the IMF, and $1 billion from the UAE. This influx of funds boosted the SBP’s reserves by $4.203 billion. It reached $8.727 billion, marking the highest level since October 2022.

Prior to this development, Pakistan’s $350 billion economy was facing turmoil. Since November when a $1.1 billion IMF tranche, part of a $6.5 billion Extended Fund Facility (EFF) agreed upon in 2019, was withheld by the IMF. The government had been in talks since January to resume the program. But faced difficulties in resurrecting it, leading to persistent discussions of the country potentially defaulting.

However, the situation turned around on June 30 when Pakistan and the IMF reached a staff-level agreement (SLA) on a $3 billion “stand-by arrangement” (SBA). This agreement paved the way for inflows from Saudi Arabia on July 11 and the UAE on July 18. While the IMF’s Executive Board approved the 9-month SBA on July 12.

The availability of multilateral and bilateral funds played a crucial role in enabling Pakistan’s deal with the IMF. Which had been stalled for over nine months and expired. High inflation and foreign exchange reserves are barely sufficient for a month of controlled imports. Analysts warned that Pakistan’s economic crisis could have led to a debt default without the IMF bailout.

In summary, Pakistan’s foreign reserves have received a boost after financial support from the IMF, UAE, and Saudi Arabia, and the agreement on a $3 billion SBA with the IMF has helped stabilize the country’s economic situation and avoid a potential debt default.