The government will not show leniency towards willful tax defaulters from the next fiscal year, warned Finance Minister Shaukat Tarin Wednesday.

The minister was speaking informally to reporters at the Parliament House where he said the government will ntake action against those who ignore tax notices sent by the Federal Board of Revenue (FBR).

The finance minister said the government has agreed to provide relief to different sectors on the Senate’s recommendations, adding that their proposals were accommodated in the budget.

Finance Minister Shaukat Tarin Wednesday said the government would not spare any wilful tax defaulters, and those who would ignore tax notices of the FBR would have to face consequences.

He spoke about the budget, saying that it would be implemented by the government’s machinery from July 1 as it is expected to get the Parliament’s nod next week.

“We are ready to negotiate with all stakeholders and after taking all of them into confidence, effective enforcement will be done,” he maintained.

In a stern warning to taxpayers, Tarin said there used to be a time when entities would ignore and not respond to notices issued by the FBR.

Making it clear that tax defaulters will not be allowed to harass or intimidate taxpayers, the minister made it clear that willful tax defaulters will not be treated with leniency.

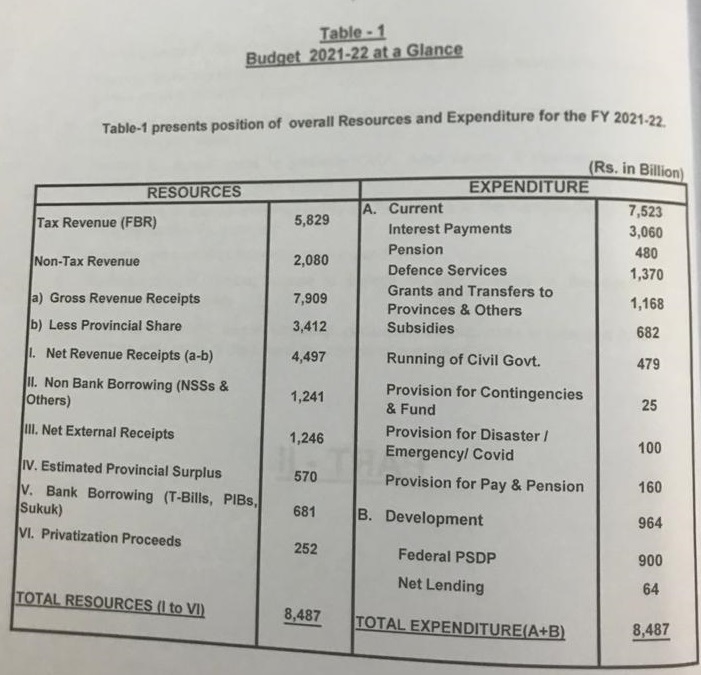

Budget 2021-22 at a glance

The government unveiled the budget for the fiscal year 2021-22 on June 11, with the outlay kept at Rs8,478 billion and the tax target set at an ambitious Rs5,829 billion.

Resources:

The government has set the target of tax revenue at Rs5,829 billion, non-tax revenue at Rs2,080 billion (gross revenue receipts to be Rs7,909 billion, of which provinces will get Rs3,412 billion). Other than that, non-revenue receipts are expected to be 4,497 billion, non-bank borrowing to touch 1,241 billion, net external receipts to come in at 1,246 billion, bank borrowing to be Rs681 billion and privatization proceeds to fetch Rs252 billion. The provinces are also expected to run a surplus of Rs570 billion, which the government will repurpose to finance its spending.

The expenditures:

Current expenditures will include interest payments of Rs3,060 billion, pensions of Rs480 billion, defence services spending of Rs1,370 billion and grants and transfers to provinces and other subsidies of Rs1,168 billion. The running of civil government is expected to incur Rs479 billion, while contingencies have been given Rs25 billion. A separate provision of Rs100 billion has been made for disaster, emergency, and COVID. There is a separate provision for ‘pay and pension’ of Rs160 billion. Apart from this, development expenditures under the federal Public Sector Development Programme have been allocated Rs900 billion, while the government also expects to lend Rs64 billion for development purposes.

Media person and communication expert for over 25 years. Worked with Dow Jones News, World Bank, CNBC Pakistan, Aaj TV, ARY TV, Abbtakk TV, Business Recorder, Pakistan Observer, Online News Network, TTI Magazine and other local and world Publications.