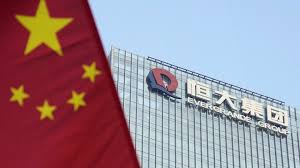

Evergrande seeks protection under Chapter 15 of bankruptcy code.

ISLAMABAD: China Evergrande, recognized as the property developer with the highest debt burden globally and emblematic of China’s real estate turmoil, submitted a request for safeguarding against creditors in a US bankruptcy court.

The company has utilized the safeguard offered by Chapter 15 of the US bankruptcy code. This chapter offers a shield to non-US companies that are presently in the process of restructuring, safeguarding them against potential lawsuits from creditors or attempts to tie up assets within the United States.

Tianji Holdings, a related entity, also initiated proceedings for Chapter 15 protection in a Manhattan bankruptcy court, yesterday.

Requests for comment made to a lawyer representing Evergrande have not received an immediate response.

Evergrande’s Escalating Crisis: Debt Woes, Defaults, and Restructuring Plans

Evergrande’s submission comes at a time of escalating concerns that issues within China’s real estate sector could propagate to other sectors of the nation’s economy, given the deceleration in growth.

Since the onset of the debt crisis within the sector in mid-2021, companies responsible for 40% of Chinese home sales have defaulted.

Investor apprehension has extended to the well-being of Country Garden, China’s largest privately-operated developer, following the company’s recent failure to fulfill certain interest payments earlier this month.

Evergrande, with a recent liability total of $330 billion, triggered a series of defaults among other builders in late 2021, leading to the abandonment of numerous residential projects throughout China.

In the preceding month, Evergrande reported a combined loss of $81 billion for the years 2021 and 2022, causing concerns among investors regarding the feasibility of its debt restructuring proposal put forth in March.

Moreover, on Monday, its electric-vehicle unit, China Evergrande New Energy Vehicle Group, unveiled its independent restructuring plan aimed at debt reduction.

This proposal entails a $2.7 billion debt-for-equity exchange and a share sale of nearly $500 million, granting Dubai’s NWTN a 27.5% ownership stake.

Trading of China Evergrande shares was halted in March 2022.