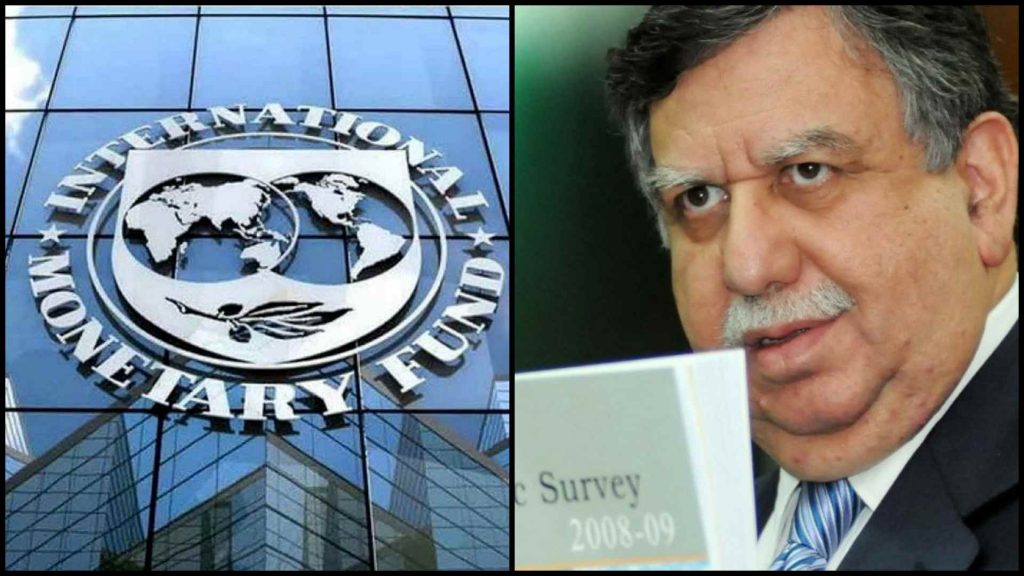

Federal Minister for Finance Shaukat Tarin has left for the US to attend the annual meetings of the World Bank and the International Monetary Fund (IMF).

Finance ministry officials on Tuesday said Tarin — who is leading Pakistan’s official entourage — will participate in policy-level talks with the IMF.

“Policy talks between Pakistan and the IMF will continue from October 13 to 15,” officials added.

During the meeting, the finance minister will brief the Fund about Pakistan’s economic performance.

The next installment worth $1 billion is likely to be received on the success of the talks.

The IMF programme under $6 billion EFF — which had been stalled since March this year — is in limbo at the moment and can only be revived if both sides evolved a consensus on the steps to move forward.

Virtual discussions on IMF conditions

In order to strike a staff-level agreement, the IMF staff has placed tough conditions such as presenting a mini-budget for hiking upward adjustments in the Personal Income Tax (PIT), especially in higher income brackets of salaried and non-salaried class, removing GST exemptions, raising Regulatory Duty (RD) on luxury items, hiking baseline electricity tariff by Rs1.40 per unit, increasing discount rates by 50 to 75 basis points, devaluation of the exchange rate to bring it in line with the real effective exchange rate and further hiking of gas tariff.

The IMF wants to jack up the Federal Board of Revenue’s (FBR) tax collection target to Rs6.3 trillion against an envisaged target of Rs5.829 trillion. It requires an additional collection of Rs500 billion. This increase in FBR’s collection will compensate for the shortfall on account of the petroleum levy that was envisaged to fetch Rs610 billion on the eve of the budget 2021-22.

Interestingly, the autonomy of the State Bank of Pakistan (SBP) and the tabled bill has been put on the backburner for the time being, so its approval would be linked to the next review.

Although the virtual talks held between the two sides identified major loopholes on the fiscal front and pointed out that there was a potential risk of Rs862 billion on the fiscal front in the shape of a petroleum levy of Rs610 billion and privatisation proceeds of fetching Rs252 billion during the current fiscal year.

Top officials in background discussions told this scribe that the IMF staff presented its wish list before the authorities during technical level talks held last week but “those have been their demands. It does not mean we have to accept them in ditto”.

The policy discussions would continue in Washington, DC, this week where Tarin, along with governor SBP and secretary finance, would make all-out efforts to convince the IMF for stall level agreement. Pakistani authorities would ask the IMF for deferring the taxation measures till the next budget and would ask to jack up the FBR target to Rs6-6.1 trillion.

The power and gas tariff will be further hiked in a gradual manner. The discount rate will be hiked by 50 basis points while exchange rate adjustments would be allowed during the coming fiscal year.

In the worst-case scenario, the government might show its willingness to present a mini bill for making changes in the income tax and sales tax but it might take some time for approval. The IMF may come up with the condition to promulgate an ordinance for making adjustments in Personal Income Tax and removal of GST exemptions at the first stage and then get the mini bill passed from the Parliament.

When contacted, Spokesperson for Federal Minister for Finance Muzammil Aslam confirmed that the technical level talks with the IMF concluded on a good note and the remaining two to three issues would be sorted out in a face-to-face review meeting scheduled to be held in Washington, DC.

Media person and communication expert for over 25 years. Worked with Dow Jones News, World Bank, CNBC Pakistan, Aaj TV, ARY TV, Abbtakk TV, Business Recorder, Pakistan Observer, Online News Network, TTI Magazine and other local and world Publications.