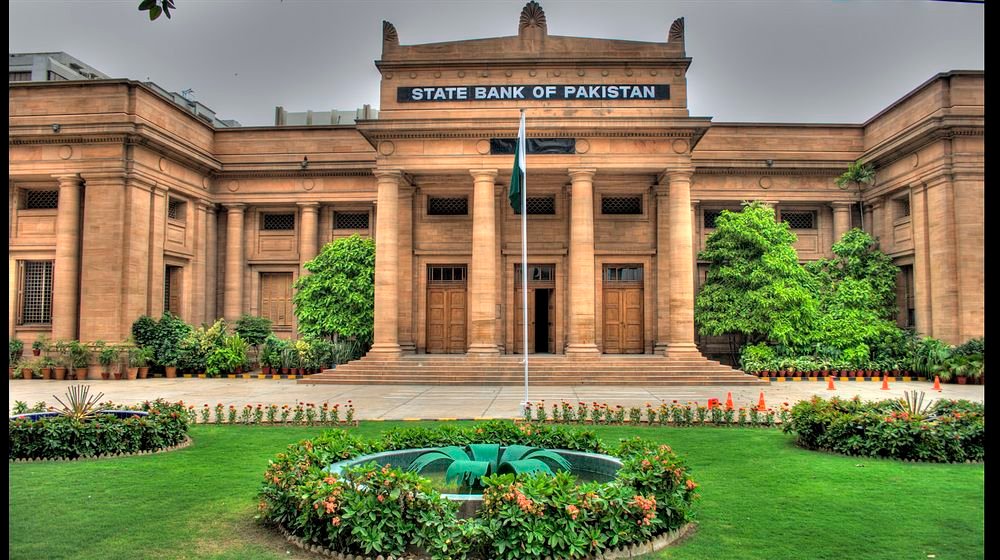

KARACHI: The State Bank of Pakistan today reduced the policy rate to 20.5 percent from 22 percent. This move reflects ease in the rate of inflation which has fallen to below 12 percent last week, from 38 percent this year.

The central bank announced the new discount rate on Monday to reduce the financial burden on the borrowers.

The Committee noted a decline in underlying inflationary pressures supported by a tight monetary policy stance and fiscal consolidation. Core inflation has been moderating, and inflation expectations of consumers and businesses are easing, according to recent surveys. However, the MPC highlighted potential upward risks to near-term inflation stemming from upcoming budgetary measures and uncertainties surrounding future energy price adjustments. Despite these risks, the cumulative impact of previous monetary tightening is expected to keep inflationary pressures in check.

Key developments since the last meeting include moderate real GDP growth of 2.4 percent in FY24, driven by strong growth in agriculture, while industry and services sectors showed subdued recovery. The current account deficit reduction has bolstered foreign exchange reserves to approximately US$9 billion, despite significant debt repayments and weak official inflows. Additionally, the government’s approach to the IMF for an Extended Fund Facility program is expected to unlock financial inflows, further strengthening FX buffers. International oil prices have decreased, while non-oil commodity prices have slightly increased.

Considering these developments, the MPC deemed it appropriate to reduce the policy rate, emphasizing that the real interest rate remains significantly positive to guide inflation toward the medium-term target of 5 – 7 percent. Future monetary policy decisions will remain data-driven and responsive to evolving developments related to the inflation outlook.

In the real sector, Q3-FY24 saw a 2.1 percent real GDP growth, with agriculture and industry showing positive growth. FY24 growth is provisionally estimated at 2.4 percent, largely driven by improvements in agriculture. For FY25, economic growth is expected to remain moderate due to anticipated moderation in agriculture output and ongoing stabilization policies.

In the external sector, the current account posted a surplus in April, driven by robust growth in remittances and exports, outweighing the increase in imports. The lower current account deficit, along with improved FDI and financial inflows, has supported FX reserves. Timely mobilization of financial inflows is crucial to meet external financing requirements and strengthen FX buffers.

Fiscal indicators showed improvement during July-March FY24, with a primary surplus increase and overall deficit stability. Fiscal consolidation through broadening the tax base and reforming public sector enterprises is emphasized for fiscal sustainability and inflation containment.

Money and credit growth decelerated, primarily due to a slowdown in domestic asset growth of the banking system. Deposit growth remained robust, while currency in circulation growth slowed. These developments align with the tight monetary policy stance and are favorable for the inflation outlook.

Headline inflation decreased in May 2024, driven by tight monetary policy and declining prices of food items and administered energy prices. Risks to the near-term inflation outlook include FY25 budgetary measures and future energy price adjustments. The MPC foresees inflation to rise in July 2024 before gradually trending down in FY25. Overall, the current monetary policy stance is deemed appropriate to ensure inflation stays on a downward trajectory.