PSX

KARACHI: The Pakistan Stock Exchange (PSX) experienced a significant upswing on Thursday, with the benchmark KSE-100 index crossing the impressive 88,000 milestone during intraday trading.

The index surged by 851.11 points, representing an increase of 0.98%, ultimately reaching a new high of 88,045.64 points. This marks a notable achievement for the PSX, continuing the positive trend seen in recent trading sessions.

According to Mohammed Sohail, the CEO of Topline Securities, the recent rally can be attributed to aggressive buying by local investors.

The optimism in the market is fueled by a combination of falling bond yields and the anticipation of a significant reduction in the monetary policy rate.

Sohail stated, “The locals are buying aggressively due to falling bond yields and expectations of a rate cut,” indicating that the market is currently pricing in a potential 200-basis-point cut in the policy rate.

Analysts widely expect the State Bank of Pakistan (SBP) to announce this reduction during its upcoming monetary policy meeting scheduled for November 4.

If implemented, this would mark the fourth consecutive cut in the policy rate since June, reflecting a shift towards a more accommodative monetary policy aimed at stimulating economic activity.

The upward momentum in the market was particularly pronounced on Wednesday, when the KSE-100 index climbed over 700 points, closing above 87,000, which also set a new all-time high.

This sustained positive trend has been driven largely by robust institutional buying, particularly in the cement and banking sectors, which have seen increased interest from investors.

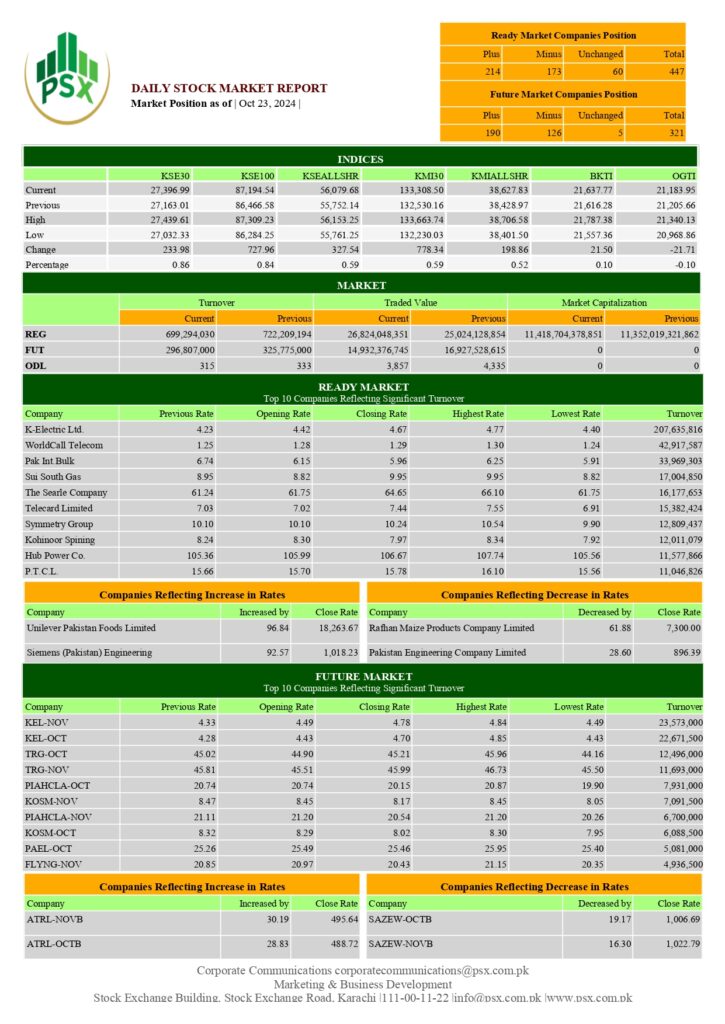

Despite the overall positive sentiment, trading volumes witnessed a slight decline, with a total of 699.3 million shares changing hands compared to the 722.2 million shares traded on Tuesday.

The total value of shares traded during the day reached Rs26.8 billion. In terms of stock performance, shares of 447 companies were traded, of which 214 stocks closed higher, 173 experienced declines, and 60 remained unchanged.

However, it is worth noting that foreign investors sold shares worth Rs366.6 million, indicating a mixed sentiment regarding foreign investment in the market.

Overall, the recent performance of the PSX underscores a growing confidence among local investors, bolstered by favorable economic indicators and the potential for further monetary easing in the near future.

I am a dynamic professional, specializing in Peace and Conflict Studies, Conflict Management and Resolution, and International Relations. My expertise is particularly focused on South Asian Conflicts and the intricacies of the Indian Ocean and Asia Pacific Politics. With my skills as a Content Writer, I serve as a bridge between academia and the public, translating complex global issues into accessible narratives. My passion for fostering understanding and cooperation on the national and international stage drives me to make meaningful contributions to peace and global discourse.