Bitcoin

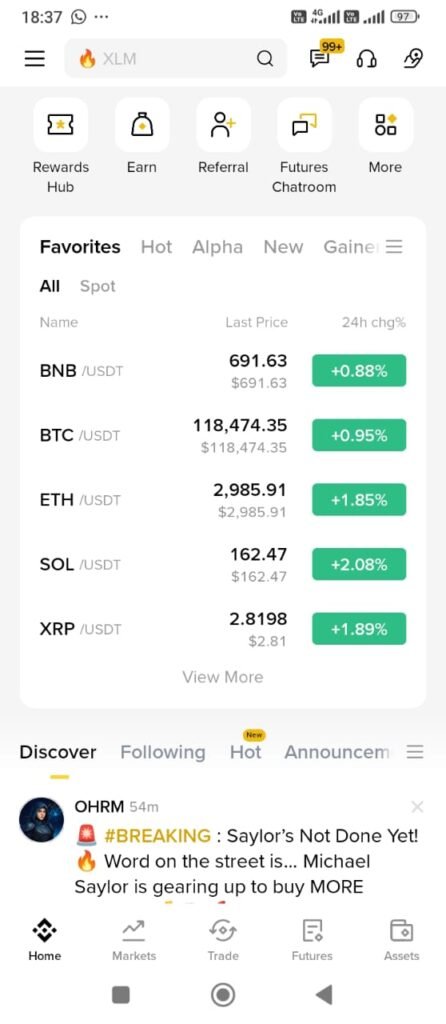

Bitcoin (BTC-USD) soared to a new all-time high on Friday, surpassing $118,000, as a wave of investor optimism swept across risk assets. The dramatic rally marks a significant milestone for the world’s leading cryptocurrency, which has gained nearly 21% year-to-date, driven by a combination of institutional inflows, favorable regulatory signals, and broader bullish sentiment in the tech sector.

The timing of Bitcoin’s breakout aligns closely with several major developments in the financial markets. Notably, tech powerhouse Nvidia (NVDA) reached a staggering $4 trillion valuation this week, underscoring the increasing convergence of cryptocurrency and technology.

The tech-heavy Nasdaq Composite (^IXIC) also recorded a fresh record high on Wednesday, while the S&P 500 (^GSPC) appeared poised to follow suit, reflecting strong market-wide momentum.

Nic Puckrin, a crypto analyst and founder of the Coin Bureau, commented on Thursday that Bitcoin’s historic correlation with tech stocks continues to hold. “We’re seeing that correlation play out again, especially as both sectors benefit from investor risk appetite and optimism around innovation,” he noted.

Beyond market dynamics, political developments have also played a role in supporting Bitcoin’s surge. The Trump administration has adopted a markedly pro-crypto stance, with policies that include the establishment of a strategic Bitcoin reserve and a broader digital asset stockpile. These actions have helped build investor confidence, particularly among institutional players.

Dilin Wu, a research strategist at Pepperstone, attributed the rally to steady structural inflows from institutional investors. “We’re not just seeing speculative retail activity — there’s a meaningful uptick in institutional adoption,” he said. Wu also pointed to growing corporate interest, with firms like MicroStrategy (MSTR) and GameStop (GME) adding Bitcoin to their balance sheets.

Additionally, Trump Media & Technology Group (DJT) filed for approval this week to launch a “Crypto Blue Chip ETF,” which is expected to allocate approximately 70% of its holdings to Bitcoin.

Bitcoin’s recent stability — trading within a $10,000 range over the past two months — is also notable given its typically volatile nature. Many analysts view this as a sign of maturing market dynamics and increased institutional participation.

The breakout comes just days before the U.S. Congress kicks off its much-anticipated “Crypto Week” on July 14. Lawmakers are set to debate a number of legislative proposals that could reshape the regulatory landscape for digital assets. One key piece of legislation is the GENIUS Act, which aims to establish a federal framework for stablecoins. The bill recently passed the Senate and is now headed for debate in the House.

Jesse Jarvis, CEO of Kaiko AI, said a favorable outcome from Crypto Week could further boost institutional confidence. “If the legislative framework provides clarity and compliance pathways, it could solidify Bitcoin’s role as a macro asset,” Jarvis explained.

Shares of crypto-related companies also responded positively. Circle (CRCL), the issuer of the USDC stablecoin, rose approximately 2% on Thursday and has gained more than 500% since its June 5 IPO. Trading platforms such as Robinhood (HOOD) and Coinbase (COIN) also saw gains, reflecting growing investor interest in crypto assets.

With institutional confidence rising, regulatory clarity approaching, and political momentum building, Bitcoin appears well-positioned to maintain its upward trajectory — potentially signaling the beginning of a new era for digital finance.