Pakistan is evaluating a time-bound amnesty for cryptocurrency traders. The idea surfaced during a major policy meeting on the country’s National Digital Asset Framework. Officials explored this option as local banks highlighted security concerns. Yet, trading data showed that Pakistani users conduct more than $250 billion in annual crypto transactions.

During the meeting, participants discussed whether a short-term amnesty could shift users toward regulated platforms. Officials noted that such a move might improve compliance. It could also bring greater transparency to the fast-growing virtual asset market.

Binance Identifies Strong Economic Potential

Senior representatives from a leading global crypto exchange presented their analysis. They argued that Pakistan’s virtual asset activity could support economic growth. Moreover, they suggested including virtual assets in the liquid money supply category. They said that collateralising digital assets could help raise M1 liquidity because these holdings are traceable.

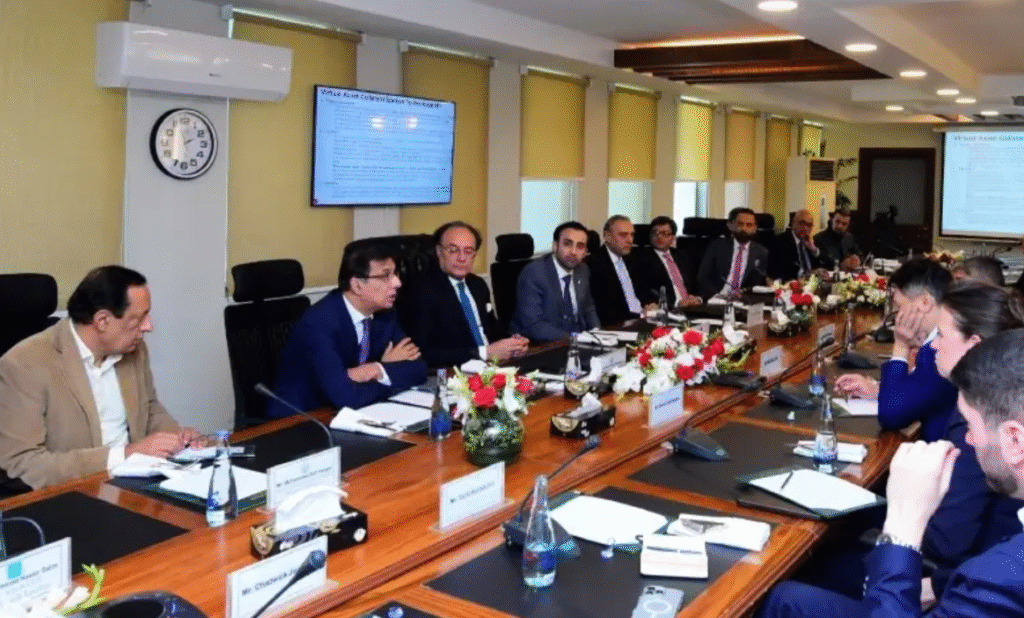

The session was co-chaired by Finance Minister Muhammad Aurangzeb and Pakistan Virtual Assets Regulatory Authority Chairman Bilal Bin Saqib. Leaders from major commercial banks joined the meeting. Senior executives from the global exchange, including its chief executive, were also present.

Digital Framework Discussions Gain Momentum

The meeting aimed to advance Pakistan’s National Digital Asset Framework. Discussions covered taxation, compliance, and safe integration of digital assets. Officials reviewed a proposed shift in oversight to licensed exchanges. They also considered introducing a gradual capital gains tax structure to support market stability.

Additionally, participants evaluated options for sovereign debt tokenisation. They noted that such tools might expand investor access and boost liquidity. Tokenised instruments could also position Pakistan as a regional leader in regulated blockchain finance.

Millions of Pakistanis Active in the Crypto Market

Officials were briefed on Pakistan’s large presence in the global crypto ecosystem. According to the exchange’s team, around 17.5 million Pakistanis are registered on the platform. Nearly four million of them are active traders. Their combined holdings total nearly $5 billion on the exchange alone. Annual trading turnover by Pakistani users is estimated at about $250 billion.

However, these figures exclude users trading with other crypto companies. The exchange explained that it has hundreds of millions of users worldwide. Yet, Pakistan stands out as a major market.

The team noted that recognising these virtual assets could unlock billions in investment value. They also said that stablecoin withdrawals might benefit the banking sector. Through Application Programming Interface connectivity, banks could assess loan liabilities. This would reduce default rates by allowing lenders to view verified asset data.

Banks Express Major Compliance Concerns

Local banks raised concerns about security, global regulatory experiences, and consumer protection. Money laundering risks were also mentioned. However, the exchange’s team said that real-time reporting could address these issues. They highlighted that digital assets and balances are visible and traceable through secure systems.

They added that cooperation with the central bank could enhance risk management. Banks would be able to estimate borrowing capacity through recognised dollar-denominated assets held on the platform. This could expand the country’s asset base and potentially increase economic activity.

Potential for New Channels of Remittances

Banks were informed that “shadow cash” tokens, or SDCs, could act as usable assets. These could support credit and loan decisions by increasing verified liquidity. Officials noted that Pakistan might attract significant foreign inflows through new remittance pathways. This would come in addition to the roughly $38 billion received annually through conventional channels.

The discussion also highlighted that US-linked development funds and credit lines might support digital initiatives. Participants believed this could stimulate growth, even though challenges remain.

Regulatory Leadership Emphasises Innovation

The head of the regulatory authority underscored the importance of digital assets. He called them critical components of modern financial infrastructure. According to him, digital tools could expand financial inclusion and offer new opportunities. Banks might gain fresh customer segments along with innovative deposit and credit products.

The meeting also reviewed operational plans for secure platforms. It stressed the importance of strong compliance standards, transparent reporting, and improved integration of regulated financial institutions.

Finance Minister Calls for Coordinated Action

The Finance Minister reaffirmed Pakistan’s commitment to supportive regulation. He emphasised the need for close cooperation among government bodies, licensed exchanges, and banks. According to him, modern digital systems must align with international standards while protecting national interests.

He stressed that Pakistan should enhance its payment systems and financial access. Updated frameworks could also improve the management of virtual assets.

Reducing Remittance Costs Through Blockchain

Participants examined the potential to transform Pakistan’s digital payments ecosystem. They noted that blockchain systems could cut remittance costs. Since Pakistan relies heavily on overseas remittances, lower fees could benefit millions of households.

They also highlighted the need for workforce development. Building strong talent pipelines in blockchain and Web3 technologies could create high-value jobs. Moreover, these skills would help Pakistan meet global demand for digital expertise.

A Transformative Moment for Pakistan’s Digital Future

The meeting signaled a significant phase for Pakistan’s digital asset policy. Although banks expressed caution, officials recognised the potential economic value of regulated crypto activity. Consequently, the proposal for a time-bound amnesty is now part of the national conversation.

If adopted, such an initiative could shift billions of dollars into the formal economy. It might also strengthen oversight and reduce risks. With rising participation in digital markets, Pakistan is preparing to balance innovation with regulation. The coming months will reveal the direction of the country’s approach to virtual assets.