KARACHI/ISLAMABAD: Jameel Ahmad, the Governor of the State Bank of Pakistan (SBP), noted a significant drop in the current account deficit from 4.8% to 0.8% during the initial four months of the ongoing financial year.

During his speech at the Pakistan Banking Award ceremony, the SBP chief emphasized the three pivotal objectives outlined in Vision 2028: ensuring economic stability, embracing economic technology advancements, and fostering economic inclusion.

He also highlighted the nation’s confronting challenges, citing the pressing issues of climate change and the rise of cybercrime.

Ahmad underscored that the Vision 2028 policy revolves around three central aspirations: securing economic stability, leveraging economic technology, and promoting economic inclusion.

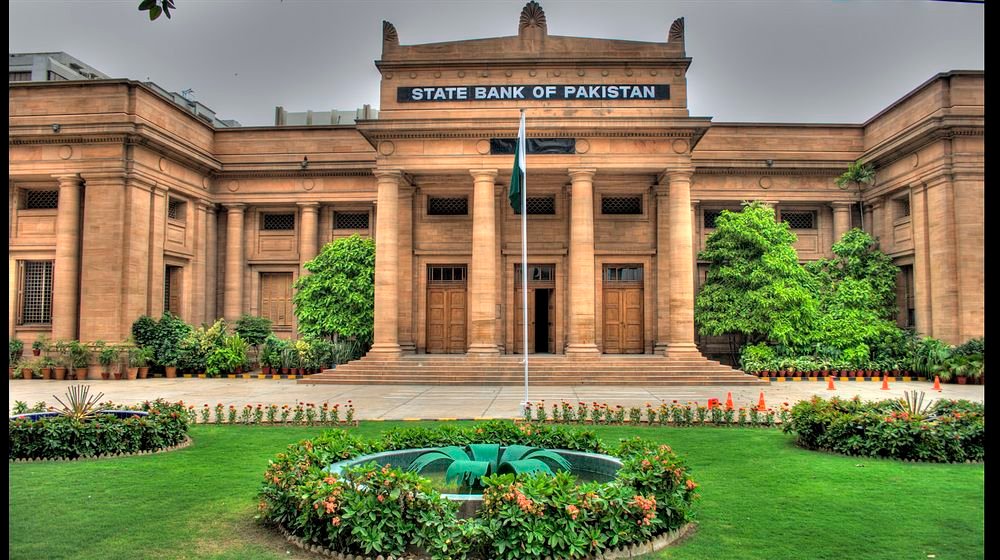

Earlier, the central bank Governor launched SBP’s strategic plan, SBP Vision 2028, for the period 2023-2028 in a ceremony held today at SBP Karachi, which was attended by the senior management of the Bank.

SBP Vision 2028, the first plan after amendments in the SBP Act, highlights the central bank’s vision, mission, and key goals to be pursued over the next five years. The strategic plan has been developed through a consultative and inclusive process with key stakeholders.

Speaking on the occasion, the Governor SBP highlighted that SBP Vision 2028 represents SBP’s commitment to foster price and financial stability and to contribute to the sustainable economic development of the country.

Mr. Ahmad added that evolving risks and challenges to the economy and financial stability, including climate change, rapid digital innovations and disruptions, and growing cyber security threats, have also been kept in perspective while developing the plan.

Governor SBP elaborated that the SBP Vision 2028, revolves around six strategic goals that include maintaining inflation within the medium-term target range, enhancing efficiency, effectiveness, fairness, and stability of the financial system, promoting inclusive and sustainable access to financial services, transforming to a Shariah-compliant banking system, building an innovative and inclusive digital financial services ecosystem, and transforming SBP into a high-tech, people-centric organization. These strategic goals are built to cover five cross-cutting themes, including strategic communication, climate change, technological innovation, diversity and inclusion, and productivity and competitiveness.