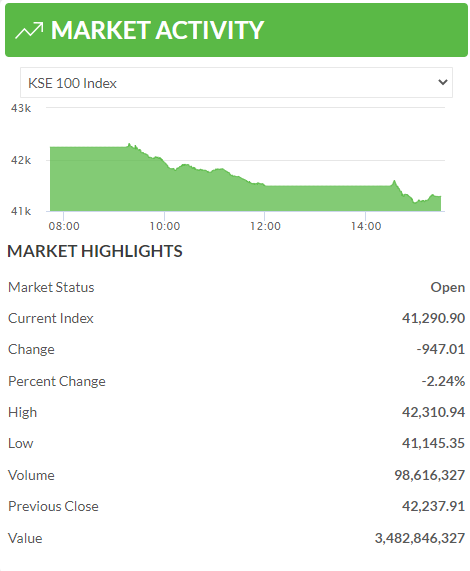

ISLAMABAD: Pakistan’s stock market has demonstrated a no-confidence over the government’s harsh decisions of raising petrol prices and tariff of electricity. The KSE-100 index of the Pakistan Stock Exchange lost 947 points on Friday _ 2.24 percent of the market’s capitalisation. At 3:30 pm the KSE-100 index plummeted to 41,290 points, from Thursday’s closing of 42,237 points.

The stock market traded 103.193 million shares involving an amount of 3.572 billion rupees till 3:30 pm on Friday.

On Thursday night, the government has shocked the entire nation by suddenly announcing another 30 rupees per liter hike in petroleum prices, raising petrol to Rs209/liter and diesel at Rs204. A few hours before this development, NEPRA notified Rs 7.90 per unit increase in the electricity tariff for the next financial year, starting from 1st July 2022.

Now the critics’ guns are towards the allied government and blaming PM and his cabinet for ruthless increase in petroleum and electricity prices in sharp contrast to its impact on price-hike and inflation-hit consumers in the country.

The government has taken these decisions to meet demand of the IMF to receive the next tranche as the foreign exchange reserves of the State Bank of Pakistan are depleting rapidly.

For example, the total reserves with the central bank have dropped to $9.722 billion as of May 27, 2022, while the commercial banks hold $6.048 billion reserves. The SBP’s reserves are equal to six weeks imports of Pakistan. Total national reserves are at $15.771 billion as of May 27.