ISLAMABAD: Bearish sentiments dominated the Pakistan Stock Exchange (PSX) as the key KSE-100 index witnessed a steep decline of over 1,500 points during Tuesday’s trading session.

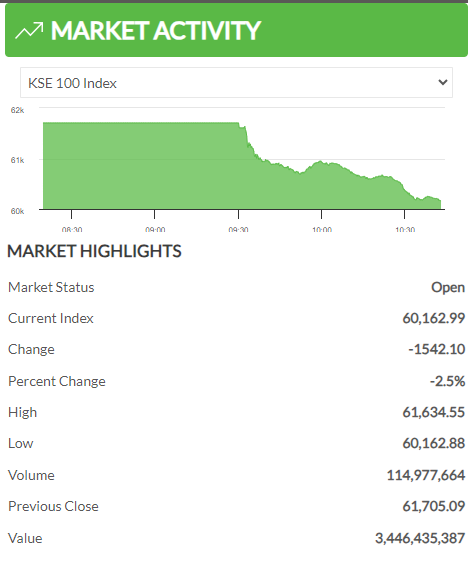

By 10:35 am, the benchmark KSE-100 had reached 60,162, marking a significant 2.42% drop equivalent to 1,542 points.

The market saw widespread selling, particularly in heavyweight sectors like automobile assemblers, cement, chemicals, commercial banks, oil and gas marketing companies, oil and gas exploration firms, refineries, and pharmaceuticals, all experiencing losses.

The volatility persisted till Friday, with the KSE-100 Index shedding close to 1,000 points, concluding at 61,705.09.

This downturn is being attributed to a correction phase following a substantial growth period where the Pakistani market surged, reaching record highs surpassing 66,000.

A notable development in this scenario was the Sindh High Court’s suspension of the SRO 1588(I)/2023 issued by the Federal Board of Revenue (FBR), imposing a 40% additional tax on banks’ windfall income.

Despite recent setbacks, Pakistan’s equities exhibited strong performance, yielding significant gains of 53%, surpassing other major asset classes throughout 2023. Local investors continued to find appeal in investment avenues like the US dollar, Naya Pakistan US$ Certificate under Roshan Digital Account (RDA), gold, and T-bills, as highlighted by experts.

On the global front, Asian stocks traded cautiously as investors digested data released the previous Friday, indicating a decline in US prices for the first time in over 3-1/2 years, signaling the economy’s resilience.

MSCI’s broader index of Asia-Pacific shares, excluding Japan, showed a 0.18% rise and was on track for a 1.6% gain for the year.

Meanwhile, Japan’s Nikkei experienced a marginal 0.07% dip but maintained its status as the top-performing Asian stock market, boasting a 27% gain for the year.