Flood-Damaged Crops Raise Inflation Fears, Prompting Policy Caution Despite Recovery Signs

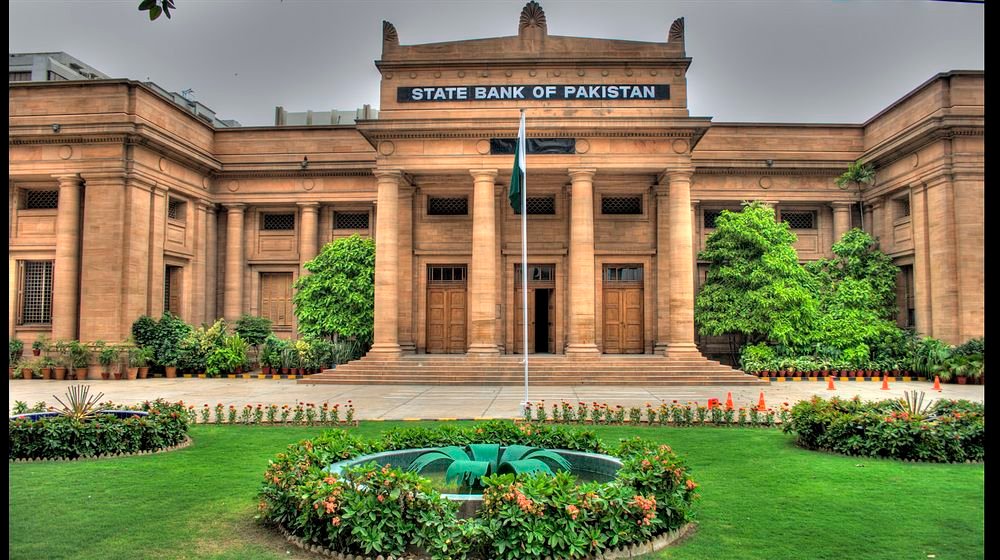

The State Bank of Pakistan (SBP) has kept the policy interest rate unchanged at 11% for the third consecutive meeting, as the country navigates a fragile economic recovery amidst growing concerns over inflation and crop damage caused by ongoing floods. This decision, announced during a Monetary Policy Committee (MPC) meeting on Monday, comes as fans gear up for the high-stakes India vs Pakistan clash in the Asia Cup 2025, prompting Dubai authorities to issue strict warnings to maintain public order.

Since June 2024, the SBP had slashed the policy rate by 1,000 basis points in seven phases, bringing it down from 22% to 11% by May 2025. Despite growing calls from the business community for further rate cuts to stimulate economic activity, the central bank chose to hold steady, citing uncertain macroeconomic conditions.

According to the MPC, inflation remained “relatively moderate” in July and August, and core inflation continued to decline—albeit slowly. Economic activity showed signs of momentum, especially in large-scale manufacturing (LSM). However, the recent flood-induced damage to crops has raised concerns about short-term inflationary pressure and a potentially wider current account deficit in fiscal year 2026 (FY26).

“This temporary yet significant flood-induced supply shock, particularly to the crop sector, may push up headline inflation and the current account deficit,” warned the MPC. The committee stressed the importance of maintaining stability amid uncertainty, and highlighted the need for continued fiscal discipline and coordinated policy support.

Business Community Reacts to Unchanged Rate as PSX Shows Signs of Recovery Post-Announcement

Despite the challenges, the MPC noted that the economy is better positioned to handle such shocks compared to past crises, thanks to improved external and fiscal buffers. Meanwhile, the Pakistan Stock Exchange (PSX) responded positively to the announcement, bouncing back above the 155,000-point mark after a recent dip.

A CFA Institute survey found that 92% of respondents expected the rate to remain unchanged. Finance Minister Muhammad Aurangzeb previously hinted at room for rate cuts later in the year but emphasized that monetary policy decisions rest solely with the SBP.

As flood recovery continues and Asia Cup fever grips the region, the SBP’s cautious stance reflects a balancing act between supporting growth and controlling inflation.