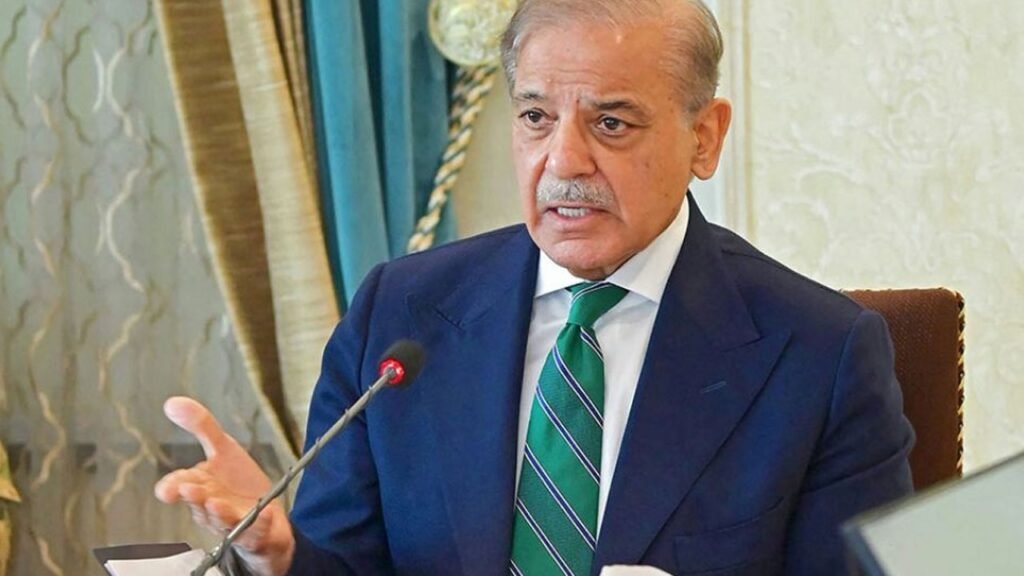

Prime Minister Shehbaz Sharif has officially launched Mashreq Digital Retail Bank in Pakistan. The inauguration marks a major step toward building a cashless and modern digital economy. The new venture is set to boost financial inclusion, empower the youth, and strengthen Pakistan’s digital transformation journey.

During the launch event, Prime Minister Shehbaz Sharif congratulated Mashreq Bank Chairman Abdul Aziz Al Ghurair. He appreciated the introduction of the UAE-based digital banking platform in Pakistan. The prime minister also highlighted the Ghurair family’s efforts in supporting Pakistan-UAE economic cooperation. He described the initiative as a boost to financial inclusion and an opportunity for the younger generation.

Shehbaz Sharif emphasized that the youth of Pakistan present both a challenge and an opportunity. He added that a digital banking revolution would provide young people with innovative tools to shape a modern economic future. He assured full government support for Mashreq Digital Bank’s operations.

The prime minister further stressed that Pakistan’s conventional economy needs modernization. He pointed out that sectors such as banking, agriculture, and investment demand digital transformation. According to him, embracing technology is necessary for achieving sustainable growth.

Finance Minister Muhammad Aurangzeb also addressed the ceremony. He stated that Mashreq Bank’s entry will bring innovation, inclusivity, and resilience to the financial ecosystem. He explained that international credit rating agencies have recognized Pakistan’s recent macroeconomic progress. However, he stressed that long-term stability depends on policy consistency. Aurangzeb also noted that the bank would play an important role in documenting the informal economy. This step will help bring millions of unbanked citizens into the formal financial system.

Mashreq Bank Chairman Abdul Aziz Al Ghurair praised the leadership of Prime Minister Shehbaz Sharif. He said that under the prime minister’s guidance, Pakistan’s economy has shown signs of stability and inclusive growth. He explained that this vision gave Mashreq the confidence to invest in Pakistan’s banking sector. Al Ghurair described Pakistan as an emerging digital economic powerhouse in South Asia.

Meanwhile, Mashreq Pakistan CEO Muhammad Hamayun Sajjad revealed some key insights about the country’s digital landscape. He shared that digital transaction volumes in Pakistan had already grown by 35 percent. However, a significant portion of the population remains unbanked. To bridge this gap, Mashreq Digital Bank aims to onboard 10 million new users into the formal digital financial system.

The establishment of Mashreq Digital Bank is being seen as a major step in reshaping Pakistan’s financial future. It is expected to accelerate the adoption of digital payment solutions, reduce reliance on cash, and promote financial literacy. Experts believe that this development will contribute significantly to documenting the economy and enhancing transparency.

The launch also reflects growing confidence among international investors in Pakistan’s economic reforms. As the country continues to modernize its financial infrastructure, digital banking is becoming a central pillar of its long-term growth strategy.

With strong government support, private sector investment, and rising consumer adoption, Pakistan is now positioning itself as a leader in digital banking innovation within the region.