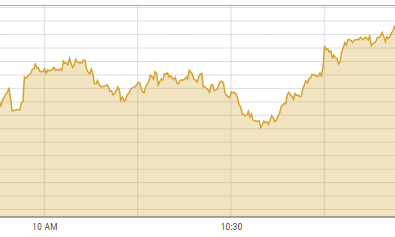

On Wednesday, the Pakistan Stock Exchange (PSX) achieved a significant milestone as its benchmark KSE-100 index surpassed the 52,000-point mark. The index rose by 422.36 points, or 0.81%, closing at 52,342.63 points, up from the previous 51,920.27 points.

The market experienced gains following the State Bank of Pakistan’s decision to maintain its policy rate at 7% as part of efforts to control inflation, which aligned with the expectations of most analysts.

Raza Jafri, the head of Intermarket Securities, pointed out that the sharp focus on the economy, prospects of future monetary easing, and optimism about a successful International Monetary Fund (IMF) review supported the market’s rally. He also noted that despite the rally, valuations in the market were still significantly lower than the long-term average.

Ali Malik, the CEO of brokerage firm First National Equities, attributed the bullish market to an improved economic situation and the anticipation of elections taking place by the end of January. He also mentioned that company earnings had been positive during this period.

While the index showed a substantial increase, market volume remained relatively low. Notable trading activity occurred in stocks like Cnergyico PK Limited, Worldcall Telecom Limited, Pakistan Refinery Limited, Ghani Global Holdings Limited, and Pak Elektron Limited.

The top-performing stocks included Ghazi Fabrics International Limited, Premier Insurance Limited, First Paramount Modaraba, The Universal Insurance Company Limited, and Dandot Cement Company Limited. On the other hand, the top decliners included Reliance Insurance Company Limited, S.G. Power Limited, First Al-Noor Modaraba, Khyber Tobacco Company Limited, and J.K. Spinning Mills Limited.