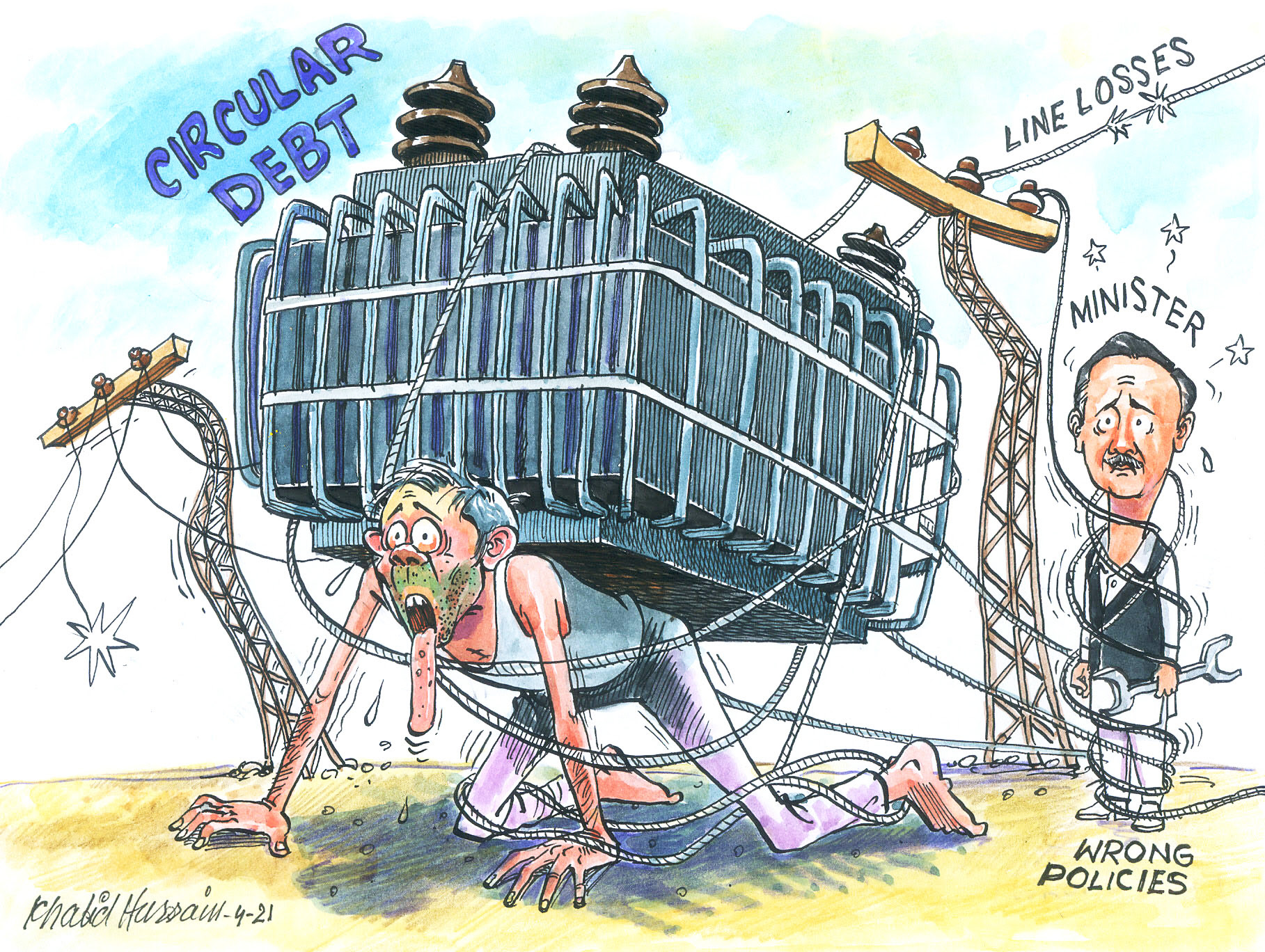

The snowballing of circular debt in the energy sector is Pakistan’s topmost macroeconomic issue, given its spill-over into myriad areas of the economy. It is without exaggeration that the long run viability of the country’s energy supply chain is at stake.

Pakistan has been mired in a crippling power crisis since the 1990s, which intensified since 2007, imposing punishing costs on the country’s economy. According to a report released last week by economics research firm Macro Economic Insights, the power crisis cost Pakistan USD 82 billion in lost GDP between 2007 and 2020.

The nature of the crisis has evolved over the years from one of chronic power supply deficits to one where there is excess installed capacity but not enough cash flow in the system to run it. The latter gives rise to the circular debt issue.

Specifically, the term ‘circular debt’ in the context of Pakistan’s energy supply chain refers to the cash flow shortfall incurred in the power sector from the non-payment of obligations by consumers, distribution companies, and the government.

Given its complex nature, and within the institutional context and political economy realities, a resolution of the issue is unlikely in the medium term despite efforts by the current government.

Unless more robust and concerted measures are taken across the entire power sector, the circular debt stock is projected to continue to rise significantly over the foreseeable future.

A crippling burden

The circular debt stock in the power sector has increased 3.5 times (by 250 percent) since 2016, from PKR 689 billion to an estimated PKR 2,400 billion as of end-December 2020. At the end of FY2020, it stood at 5.2 percent of GDP.

Pakistan’s power crisis cost USD 82 billion in lost GDP between 2007 and 2020. In per capita terms, the power crisis cost each Pakistani PKR 43,504 during this period, with rupee per capita GDP lower by 23 percent as a result.

The lower GDP growth cost approximately 0.9 to 1.6 million jobs a year on average between 2007 and 2018. At the lower-bound, this amounts to a cumulative 10.9 million jobs that could have been saved or created during the 12-year period.

Fiscal costs to the budget amounted to a further 1.2 percent of GDP each year on average between FY2007 to FY2019. Total budgetary support to the power sector has amounted to PKR3,202 billion (USD 31.4 billion at the average exchange rate). The combined welfare costs of the power crisis are likely to be significantly higher.

The worst part is that a resolution to the problem is nowhere in sight. The circular debt stock is conservatively projected to increase to over PKR 4,900 billion by FY2025 (an increase of 2.04 times from current level) under the base scenario.

The makings of the crisis

There are several reasons for this sharp accumulation of power sector circular debt almost all of them rooted in policy options exercised by successive governments.

The steep rupee devaluation of 2018-19, coupled with an increase of nearly 13,300 MW (52 percent) in new generation capacity since 2016, led to a sharp increase in total payments to IPPs from PKR 724 billion to PKR 1,496 billion in FY2020. This represents a 106 percent increase.

An increase of about 76 percent in cost of generation versus an increase of about 39 percent in average tariff during this period also caused the circular debt to balloon.

A decrease in recoveries from 94 percent to 89 percent over this period further pushed the circular debt upwards. Recoveries deteriorated due partly to waivers and forbearance in bill collection during April-May 2020 in the wake of the outbreak of the Covid-19 global pandemic. However, the trend does not appear to have been favourable even prior to the Covid-19 situation.

Another key factor contributing to the accumulation of circular debt has been the inability of the government to pay off the circular debt stock due to lack of fiscal space.

Finally, the higher financing costs incurred due to a larger base of outstanding circular debt combined with the sharply higher interest rates prevalent in 2018 and 2019 drove the debt stock even higher.

Shockwaves from the crisis

Between 2007 and 2020, the power shortfall caused a national output loss of about 2.5 percent annually. Cumulatively, the lost GDP amounts to USD 82 billion for this 14-year period at the average exchange rate. In per capita terms, the power crisis has cost every Pakistani PKR 43,504 during 2007-2020, with rupee per capita GDP lower by 23 percent.

The impact on employment has been severe as well. For a range of employment elasticities of growth used by the Planning Commission and Pakistan Institute of Development Economics (PIDE), it is estimated that the lower GDP growth cost approximately 0.9 to 1.6 million jobs a year, on average, between 2007 and 2018.

Note, however, that this is not necessarily an estimate of actual jobs lost, but the counter-factual number of additional jobs that could have been created if there was no power crisis in the country.

The build-up of circular debt has undermined the viability of the country’s energy sector, hurt industry and exports, and impacted new investment and job creation. It has also destabilised Pakistan’s fiscal management and imposed prohibitive opportunity costs in terms of pre-empting government spending on infrastructure and social expenditure, as well as credit in the banking system.

Given the magnitude and trend of the problem, its linkages with the rest of the economy, and large negative externalities, the accumulation of power sector circular debt will continue to be one of Pakistan’s foremost macroeconomic challenges in the years to come.