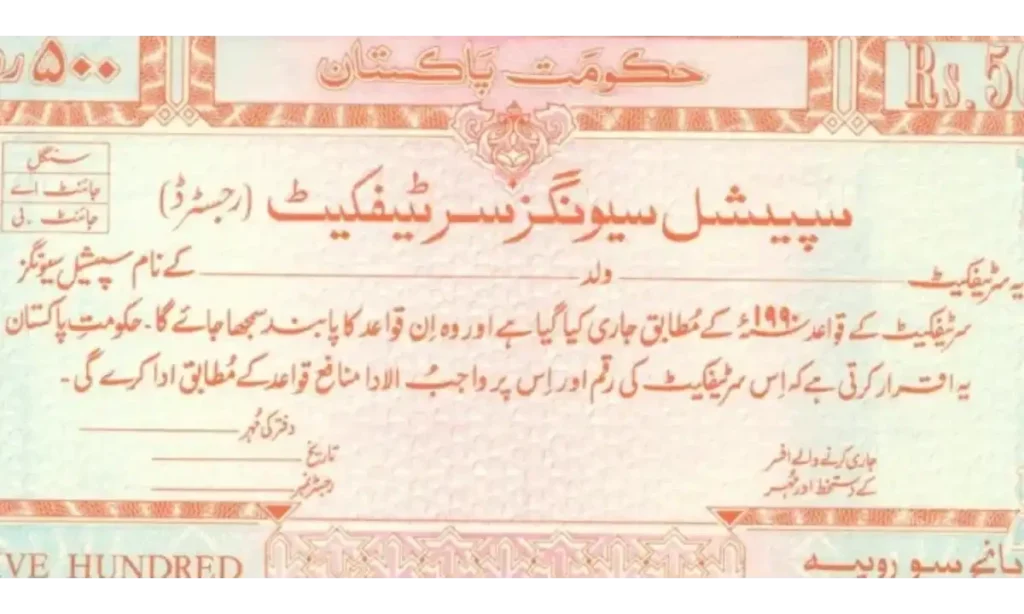

Special Savings Certificates

National Savings, also known as Qaumi Bachat Bank, has announced revised profit rates on its Special Savings Certificates effective from July 2024, aiming to offer attractive returns amidst changing economic conditions.

The updated rates will apply to the next three-year term of the investment scheme, which remains popular among small and medium-range investors.

For the initial five months of the six-month profit period, the profit rate has been fixed at 15.7% per annum. Subsequently, for the sixth and final month of the term, investors can expect a higher rate of 16.6% per annum.

Alongside the rate adjustments, the government has clarified the tax implications for investors in these certificates.

Active Taxpayers will face a 15% withholding tax on their profits, while non-filers or individuals not listed as Active Taxpayers will be subject to a higher withholding tax rate of 30%.

The Special Savings Certificates represent a structured three-year investment opportunity provided by National Savings.

Investors receive bi-annual profits on their principal amount, making it an appealing choice in the financial landscape.

This revision in profit rates is designed to maintain the scheme’s competitiveness and appeal in light of ongoing economic shifts.

By offering enhanced returns, National Savings aims to incentivize savings and investments among individuals seeking stable and rewarding financial avenues.

The policy adjustment reflects a proactive approach by National Savings to adapt to economic dynamics, ensuring that savers receive competitive returns on their investments.

It underscores the government’s commitment to supporting financial inclusivity and encouraging savings culture across various segments of the population.

Investors looking to capitalize on these revised rates are encouraged to consider the benefits of Special Savings Certificates as a reliable investment option.

With its structured profit distribution and tax implications clearly defined, this scheme continues to serve as a viable choice for those seeking stable and lucrative investment opportunities amidst evolving market conditions.