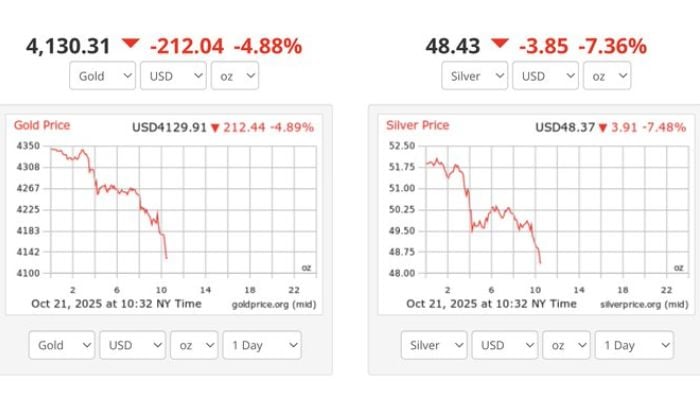

Gold prices suffered their steepest single-day drop in over a decade, tumbling 5.7% to $4,109 per ounce and erasing nearly $1.75 trillion from the metal’s global market value — a stark contrast to Bitcoin’s record-breaking rise to $114,000.

The dramatic reversal followed a historic rally that had pushed gold above $4,380 just a day earlier. Analysts attributed the correction to a combination of profit-taking and shifting investor sentiment.

One expert noted that gold’s 60% rise this year created an inevitable pause, calling the move “a classic case of short-term profit-taking after a parabolic rise.”

Several external factors also contributed to the sell-off. A strengthening U.S. dollar, easing U.S.-China trade tensions, and robust third-quarter corporate earnings reduced the short-term appeal of safe-haven assets. Additionally, the end of India’s Diwali season — typically a period of peak gold demand — weakened physical buying momentum.

The broader precious metals market followed suit, with silver plunging 8.7% to $49.70, marking its worst performance since 2021. Large gold mining stocks also suffered heavy losses as investor focus shifted.

Meanwhile, the cryptocurrency market experienced a contrasting boom. Bitcoin gained 2% to hit $114,000, sparking more than $150 million in short liquidations and reinforcing the bullish outlook for digital assets.

The simultaneous gold crash and Bitcoin surge highlighted an expanding divergence in investor preference between traditional and digital stores of value.

Despite the short-term volatility, analysts believe gold’s long-term fundamentals remain strong, citing ongoing geopolitical uncertainty and persistent financial risks as factors that will continue to support the metal’s value in the future.