ISLAMABAD: The Lahore-based Centre for Economic Research in Pakistan (CERP) has found an alarming slowdown in overall economic recovery in Punjab with rural areas continuing to deteriorate in recent months.

Releasing the findings from its January 2021 Economic Vulnerability Assessment (EVA) based on a phone survey noted that although employment rebounded significantly between June-July 2020 (Round 1) and September-October 2020 (Round 2), the Dec 20-Jan 21 (Round 3) data showed that the labour market recovery had stagnated.

The fraction of individuals unemployed fell from 33.7pc in Round 1 to 21pc in Round 2, and remains at 21pc in Round 3. Average urban incomes decreased by almost 32pc in Round 1 (between February 2020 and May 2020), 11pc in Round 2 (between February 2020 and August 2020), and 9.5pc in Round 3 (between February 2020 and January 2021).

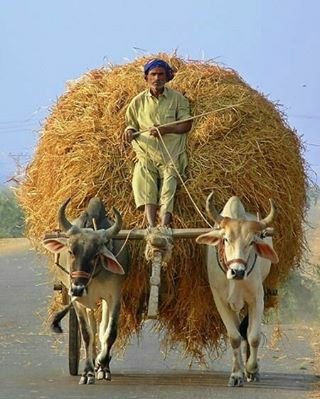

Although rural respondents reported significantly lower losses on average in Round 1 (17.5pc), rural areas saw a relapse between Rounds 2 and 3 while income losses decreased to 10pc in Round 2, they deteriorated to approximately 15pc in Round 3.

The Round 3 data continues to show heterogeneity in recovery patterns. Higher-educated individuals – those with more than matric schooling – experienced disproportionate income losses initially but also saw a larger rebound in incomes between Rounds 1 and 2, compared to those with lower education levels.

Among respondents with more than matric schooling, 55.7pc reported an income loss (relative to February 2020) in Round 1. This share fell to 37pc in Round 2, and about 30pc in Round 3. For those with lower levels of education, the recovery is weak and stagnating: among respondents with less than matric schooling, 45.8pc reported an income loss (relative to February 2020) in Round 1. The corresponding proportions were 40.7pc in Round 2, and 41.6pc in Round 3.

Rural households expectations for month-ahead income (for February 2021) are worsening: they expect larger month-ahead income losses (a drop of 4.7pc in Round 3, versus an expected decline of 1.5pc in Round 2). Urban households’ expectations for income (for February 2021) are unchanged between Rounds 2 and 3, with these households expecting income losses of 2.6-2.8pc in the month ahead.

Short-term income expectations remain higher for households earning below-median income in February 2020: a month-ahead average expected increase of 3.2pc, relative to an average decrease of 8.5pc for households earning above-median income in February 2020.

Longer-term (year-ahead) income expectations remain positive and high for all subgroups. Unlike incomes, household spending had fully recovered to its February 2020 levels in urban and rural areas alike in Round 2. However, in Round 3, rural areas report a 1.7pc decrease in spending compared to Feb 2020, whereas urban areas report an increase of 0.8pc. Households expect spending to continue to grow in the short term (an overall increase of 6.1pc in the upcoming month). Expectations for spending in the next month do not differ systematically between rural and urban areas.

Financial distress – in terms of a household’s ability to pay bills – remains high, affecting 1 in 5 households in urban areas and 1 in 3 households in rural areas. Despite a sharp decline from Round 1, when 45pc of urban and 51pc of rural households missed at least one payment, the proportion in round 3 is similar to that in Round 2, with almost 23pc of households in urban areas and 32pc in rural areas having missed at least one monthly payment in the last two months.

In Round 3, 23pc of households reported borrowing money in the past two months (November-December 2020), which is unchanged from Round 2. Family and friends remain the main source of borrowed money, with respondents still borrowing amounts significantly higher than their income in February 2020.

There has been a troubling increase in the fraction of households reporting food insecurity, i.e., inability to buy essential food items in the last 7 days, with 1 in 5 rural households being food insecure in Round 3. The fraction of food-insecure households increased from 9 to 14.2pc in urban areas, and from 16pc to 21.7pc in rural areas, between Rounds 2 and 3. Lack of resources and inflation were cited as the main reasons for this food insecurity.