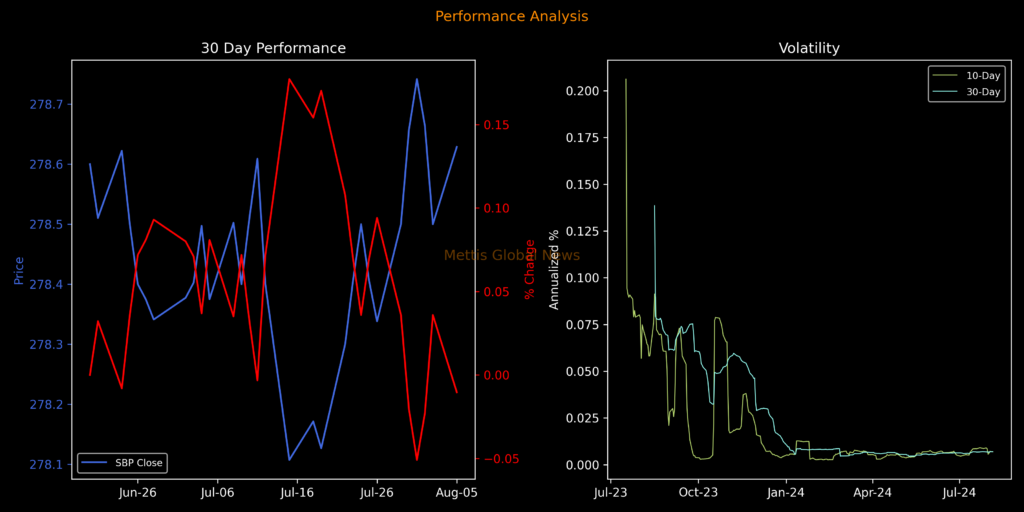

On Monday, the Pakistani rupee (PKR) experienced a depreciation of 12.89 paisa against the US dollar in the interbank market, settling at PKR 278.63 per USD.

This decline follows the previous session’s closing rate of PKR 278.50 per USD. Throughout the trading day, the PKR saw an intraday high (bid) of PKR 278.80 and a low (ask) of PKR 278.60.

This recent drop adds to the PKR’s losses from the previous week, during which the currency lost over 16 paisa against the USD.

In the open market, exchange companies quoted the US dollar at 279.21 for buying and 280.41 for selling, reflecting a broader trend of depreciation for the PKR.

The rupee’s decline was not confined to the US dollar alone. The PKR also depreciated significantly against several major currencies.

It fell by 4.67 rupees against the Euro, closing at 305.49 compared to 300.82 in the previous session. Similarly, the Swiss franc surged by 8.04 rupees, closing at 327.63 compared to 319.58 from the prior day.

The Japanese Yen saw a sharp increase as well, with the PKR plummeting by 7.92 paisa, closing at 1.9469 versus 1.8677 a day earlier.

This appreciation of the Japanese Yen, reaching its highest level against the US dollar since January, was attributed to a broad selloff in financial markets spurred by fears of a US economic slowdown and rising tensions in the Middle East.

The Yen’s rise could impact Pakistan’s car prices, as noted by Ismail Iqbal Securities, due to the Bank of Japan’s unexpected interest rate hike on July 31.

The British Pound also saw an increase, becoming more expensive by 2.84 rupees and closing at 356.97 compared to 354.13 previously.

The Chinese Yuan gained 42.64 paisa, ending the day at 39.02 compared to 38.60 before. The Saudi Riyal and the UAE Dirham also appreciated, with the Riyal closing at 74.22, up by 1.86 paisa, and the Dirham rising by 3.31 paisa to 75.83.

For the current financial year, the PKR has depreciated by 28.77 paisa or 0.1% against the US dollar.

However, in the current calendar year, the PKR has shown a gain of 3.23 rupees or 1.16% against the dollar.

In the Money Market, the benchmark 6-Month Karachi Interbank Bid and Offer rates have decreased slightly by 2 basis points, now standing at 19.1% and 19.35%, respectively.