Dominant Dollar

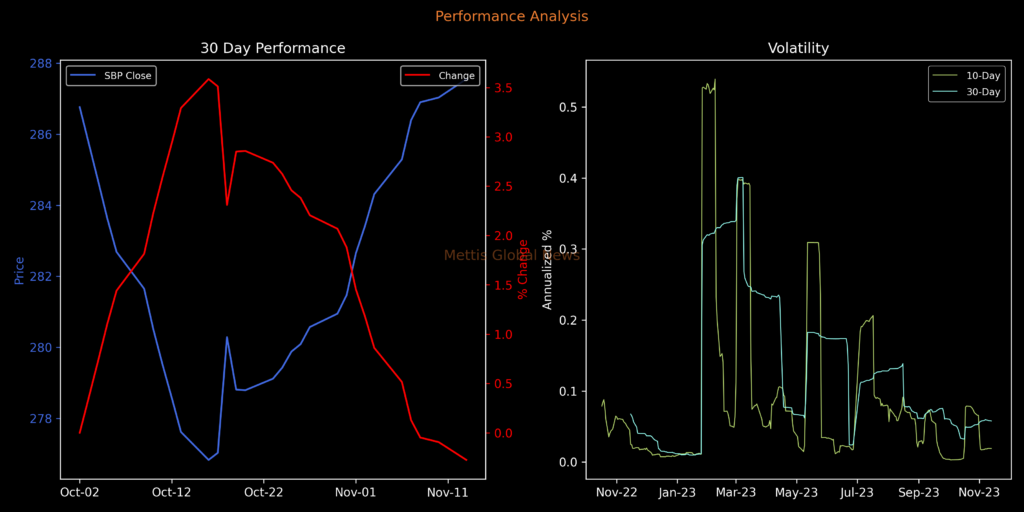

On Monday’s interbank session, the Pakistani Rupee (PKR) depreciated by 51.94 paisa against the dominant US dollar, settling the trade at PKR 287.55 compared to the previous day’s closing of PKR 287.03 per USD. The local unit experienced an intraday high (bid) of 287.55 and a low (ask) of 287.25.

In the open market, the exchange companies quoted the dollar at 288 for buying and 289 for selling, resulting in a 1 rupee loss compared to the previous closing of 287 for buying and 288 for selling. Notably, the local unit had lost around 2.7 rupees against the USD the previous week.

The market pressure, stemming from the gap between the demand and supply of dollars, persisted, marking the 15th consecutive loss for the PKR against the greenback.

The demand for dollars increased due to the easing of trade restrictions, following the conditions set by the International Monetary Fund (IMF) for the Standby Agreement. This surge in demand further strained the local currency.

October’s trade deficit for Pakistan widened by over 38% MoM to $2.099 billion compared to the previous month’s deficit of $1.518 billion.

In a positive turn, the central bank’s latest data on Workers’ remittances revealed an 11.54% MoM increase in October to $2.46 billion. This growth is attributed to the army-backed crackdown against speculators, hoarders, and smugglers, aimed at restricting illegal dollar outflows and strengthening the PKR against the USD.

The satisfaction of the International Monetary Fund (IMF)’s review mission added to the positive developments, as the country met the fund’s targets for the first quarter of the fiscal year 2023-24.

In comparison to major currencies, the PKR lost 1.16 rupees against the Euro, closed at 307.42 compared to the previous value of 306.26. The British Pound became more expensive by 1.48 rupees, closing at 352 compared to 350.52 from a day ago.

The Swiss franc gained 85.75 paisa, closing at 318.72 compared to 317.86 from the previous session. Against the Japanese Yen, PKR gained 0.05 paisa, closing at 1.895 versus 1.895 a day ago. The Chinese Yuan gained 8.61 paisa, closing at 39.4444 against 39.3583 from the previous session.

The Saudi Riyal closed at 76.67 with a gain of 14.56 paisa from its value of 76.52 a day ago. The U.A.E Dirham increased in value by 14.36 paisa from 78.146 a day ago to 78.29.

During the current financial year, PKR has depreciated against the Dollar by 1.56 rupees or 0.54%. The current calendar year has seen PKR depreciate by 61.12 rupees or 21.26%. In the Money Market, the benchmark 6-month Karachi Interbank Bid and Offer rates remained unchanged at 21.44% and 21.69%.