57000 Points

ISLAMABAD: The Pakistan Stock Exchange (PSX) KSE-100 benchmark index breached 57000 points on Thursday morning as the staff-level agreement reached with the International Monetary Fund (IMF) on the first review of the $3 billion stand-by arrangement boosted the investors’ confidence.

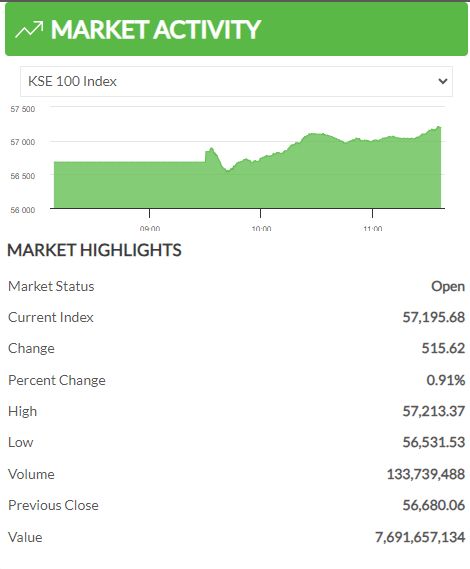

The market had closed at 56,680.06 points on Wednesday, nonetheless, on Thursday morning, the KSE-100 index gained 515 points this morning and further surged to 57,160 points by 11:35 am.

The bullish trend means that the Pakistan Stock Exchange is becoming more and more lucrative for investors when compared with the unproductive real estate sector, which, in some cases, has been witnessing stagnation and even a decline in prices.

Moreover, the rising stocks will certainly also discourage investment in safe haven currencies like the dollar and assets like gold.

Pakistan’s economy has been battered by record-high inflation and interest rates, which means there is very little or no economic activity that can help people lessen the cost-of-living crisis by getting new jobs or enhanced wages.

Meanwhile, on Wednesday night, the IMF said that its team, led by Nathan Porter, visited Islamabad from November 2-15, 2023, to hold discussions on the first review of Pakistan’s economic program supported by an IMF Stand-By Arrangement (SBA). At the conclusion of the discussions, Mr. Porter issued the following statement:

“The IMF team has reached a staff-level agreement (SLA) with the Pakistani authorities on the first review of their stabilization program supported by the IMF’s US$3 billion (SDR2,250 million) SBA. The agreement is subject to the approval of the IMF’s Executive Board. Upon approval around US$700 million (SDR 528 million) will become available bringing total disbursements under the program to almost US$1.9 billion.

“The IMF team has reached a staff-level agreement (SLA) with the Pakistani authorities on the first review of their stabilization program supported by the IMF’s US$3 billion (SDR2,250 million) SBA. The agreement is subject to the approval of the IMF’s Executive Board. Upon approval around US$700 million (SDR 528 million) will become available bringing total disbursements under the program to almost US$1.9 billion.

Windfall tax on banks

The caretaker government also levied a 40 percent windfall tax on bank profits reaped from foreign exchange transactions in the past two years.

The federal cabinet’s approval of the windfall tax came after strong criticism of banks that they had earned Rs110 billion in profits in 2021 and 2022 from the speculative rupee-dollar trade.

According to the Prime Minister’s Office, the federal cabinet approved a proposal of the Federal Board of Revenue (FBR), which said the Finance Act, 2023, introduced Section 99D to the Income Tax Ordinance 2021 to enforce the imposition of tax on windfall profits of banks.

The caretaker government was also adamant about taxing the banks’ income earned from the speculative exchange business to generate over Rs40 billion.

The government has imposed this tax to satisfy the IMF and show the lender that it was serious about boosting tax revenue collection.