Oil prices plummeted over 4% today, hitting a three-year low as trader sentiment continued to worsen ahead of tonight’s highly anticipated U.S. Presidential debate between Donald Trump and Kamala Harris.

Bearish sentiment has reached multi-year lows, with traders overreacting to negative developments and disregarding relatively stable fundamentals.

Hedge funds and money managers have grown more bearish on crude than ever since the CFTC began releasing market positioning data. Speculative positioning in crude oil is now extremely short, with Brent and WTI net longs totaling just 139,242 lots in the week ending September 3. Net speculative long bets across the four Brent and WTI contracts were a mere 2.3% of open interest—the lowest since 2011 and two percentage points below the pandemic-era low.

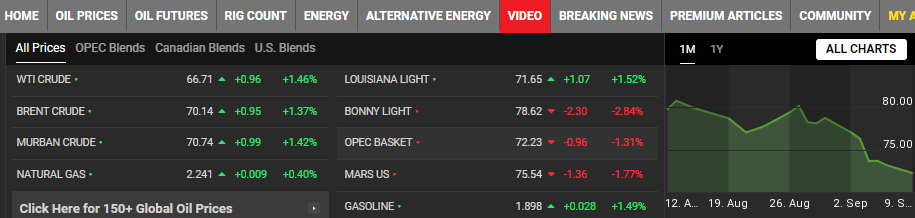

Courtesy: Oilprice.com

Over the past week, net selling reached 108.8 million barrels (mb), bringing the cumulative figure to 311.2 mb over eight weeks. Analysts at Standard Chartered reported that their proprietary money-manager crude oil positioning index has dropped to -100.0 for the first time this year. The last time it hit this level was in December 2023, followed by a sharp rally.

However, the index also hit -100.0 three times in Q2 2023, and prices didn’t bottom out until a week after the third occurrence, suggesting the potential for further net selling. Positioning for ICE Brent is dire at -93.9, but less extreme for NYMEX WTI at -51.8, with the WTI speculative long-short ratio still above historical lows.

StanChart attributes this extreme positioning to incorrect assumptions of an impending crude oil surplus and ongoing fears of a severe economic disruption. While it may take time for the oil market to shift focus to actual fundamentals, the positioning is so skewed that price risks are now tilted to the upside.

StanChart also notes little evidence of an imminent economic downturn in the latest Energy Information Administration (EIA) data. The main negatives were a counter-seasonal rise in gasoline inventories and week-on-week declines in implied demand. On the positive side, crude oil showed a -1.816 mb/d flow balance.

OPEC+ Delays Production Hike

In a key development last week, the OPEC+ oil alliance announced it would delay plans to increase production by 180,000 barrels per day in October. This was part of a broader strategy to gradually reintroduce 2.2 million barrels per day to the market in the coming months. The cuts—implemented in Q2 and Q3—were set to expire at the end of the month.

Saudi Arabia, the UAE, Russia, Iraq, Kazakhstan, Kuwait, Oman, and Algeria have committed to these voluntary reductions, which are outside of OPEC+’s official policy.