The free-fall of cryptocurrency in recent weeks has wiped out about $2 trillion from the crypto-market, causing a serious blow to mega companies and investors with large stakes in this decentralized digital currency.

In Nov 2021, the market capitalization of cryptocurrencies spiked to $3 trillion, which has fallen to less than one trillion dollars these days due to a free-fall of Bitcoin and Altcoins amid different negative developments.

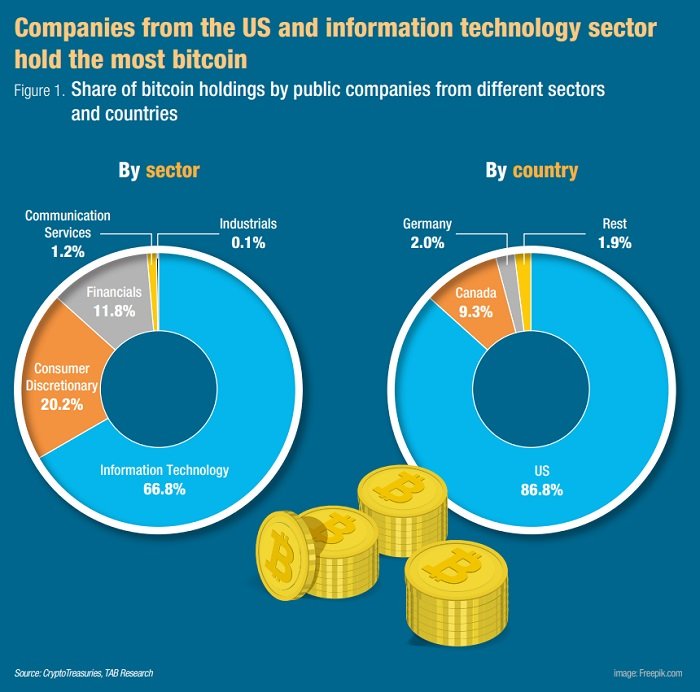

Scores of the mega companies, leading investors and individuals are facing bankruptcy-like situation because of crash of crypto to an unbelievably low level in these days. Most of the companies are being in the United States, which have acquired about 80 percent of the total Bitcoin when China launched a crackdown on illegal mining and trading of the virtual currency on the motivation of the United States, Europe and UK.

On Monday noon (July 4), Bitcoin was trading below $20,000, after hitting $66,000 level in November last year while second most active cryptocurrency _ Ethereum has fallen below $1,100, after touching $4,400 record high level in Nov-2021.

“It’s got a different flavor this time,” Jason Urban, co-head of trading at Galaxy Digital Holdings Ltd., said. Galaxy, the $2 billion digital-asset brokerage benefited immensely from crypto’s rise — but was also one of the industry’s most prominent investors in the Terra experiment.