By Javed Mahmood

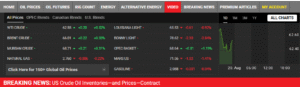

ISLAMABAD: Crude oil prices have crashed in international markets due to low demand and the negligible impact of US efforts to undermine Russian oil exports. At present, Brent crude has fallen to $66/barrel while WTI crude has declined to $62.55 a barrel on Wednesday morning.

Meanwhile, the OPEC crude oil price fluctuated to around $68.64 a barrel on Wednesday. The prices of Murban crude, Louisiana light, Bonny light, and Mars US have also declined significantly in recent days. If these prices tumble further, the Pakistan government will have to pass on to consumers the impact of declining crude oil prices in the international market.

China has boosted imports of Russia’s flagship Urals crude, as refiners buy additional volumes of discounted oil while India is hesitant amid U.S. threats over its purchases of Russian oil.

China has boosted imports of Russia’s flagship Urals crude, as refiners buy additional volumes of discounted oil while India is hesitant amid U.S. threats over its purchases of Russian oil.

From the 16th of August, the government has slashed diesel prices by Rs 12 per liter while the petrol prices were kept unchanged.

Interestingly, China has ramped up its imports of Russia’s flagship Urals crude as refiners seize the opportunity to purchase discounted oil, while India, previously a major buyer, is now scaling back its purchases under growing pressure from the U.S. over its Russian oil imports.

Historically, China has been the top consumer of Russian crude, but most of its purchases have focused on the ESPO (East Siberian Pacific Ocean) grade, which is transported from Russia’s port in Kozmino on the Far East. The Urals grade, typically shipped from western Russian ports to India, has not been a significant part of China’s imports due to higher shipping costs and longer delivery times.

However, recent shifts in global trade dynamics have led to a significant change. With the U.S. imposing higher tariffs on India for its continued imports of Russian oil, trade routes are being restructured. As a result, China and Russia have emerged as the primary beneficiaries of the changing flow of Urals crude, while India is seeing a reduction in its imports.

In August, China’s Urals crude imports surged to nearly 75,000 barrels per day (bpd), a dramatic increase from the 40,000 bpd average this year, according to data from Kpler cited by Bloomberg. Meanwhile, India’s imports have plummeted by more than half, dropping to approximately 400,000 bpd in August, compared to an average of over 1 million bpd earlier in 2025.

While some of the Urals crude previously destined for India may find its way to China, it is unlikely that China will absorb all of the surplus. Energy flow tracking by Vortexa suggests that although China may temporarily take in some additional volumes, this shift is not sustainable in the long run. Delia He, a freight analyst at Vortexa, pointed out that China absorbing the entire surplus of Urals is not a realistic scenario.

The Indian refiners, particularly the largest state-owned companies, have begun pulling back from spot purchases of Russian crude for shipments in the coming months. This decision comes as the U.S. intensifies its pressure on India to halt or reduce its Russian oil imports.

In response, U.S. officials have been vocal in their criticism of India’s reliance on Russian crude, with White House trade adviser Peter Navarro stating that India’s continued dependence on Russian oil is undermining global efforts to isolate Russia’s economy. India’s dependence on Russian crude is opportunistic and deeply corrosive of the world’s efforts to isolate Putin’s war economy.