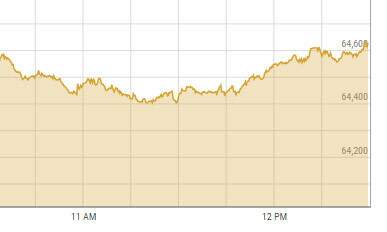

Following two back-to-back days of selling pressure, the Pakistan Stock Exchange (PSX) experienced a revival of optimism on Thursday, as it surged over 1,000 points during intraday trading.

The KSE-100 index experienced a 1.59% increase, amounting to 1,015.82 points, bringing it to 65,064.26 at approximately 1:42pm. This followed a previous close of 64,048.44. Yousuf M. Farooq, director of research at Chase Securities, attributed this positive trend to enhanced clarity in political and economic matters.

Farooq highlighted the new finance minister’s recent interview, where he presented a clear roadmap for the economy’s future and emphasized the significant improvements in stability during the first quarter of the year compared to the previous one.

He remarked, “The market has shown a favorable reaction to the minister’s hopeful and cautious remarks made yesterday. As a result, certain individuals now expect a decrease in interest rates on March 18th, which is a shift from the earlier predictions where rate reductions were not foreseen.”

During an interview, the finance minister highlighted the importance of fiscal responsibility by stressing the need to “streamline government spending.”

He also underscored the significance of attracting investments, as supportive nations prefer to assist through collaborations rather than aid.

Regarding the International Monetary Fund (IMF), the finance minister maintained his stance on finalizing the IMF program to secure the $1.1 billion tranche. Awais Ashraf, the director of research at Akseer Research, similarly emphasized the necessity of interest rate reductions.

The finance minister’s mention of monetary easing and the absence of additional conditions for the IMF’s $1.1 billion final tranche, as the country has met all necessary benchmarks, has increased investor confidence. Shahab Farooq, director of research at Next Capital Limited, believes this growth is driven by optimism about successful negotiations with the IMF regarding the final tranche of the ongoing SBA and the anticipation of a rate reduction due to the decrease in Pakistan Investment Bonds (PIB) cut-off yields in recent auctions.

Furthermore, Farooq mentioned that the “insightful remarks from the newly appointed finance minister boosted optimism at the PSX.” Nevertheless, he warned that the trading volume stayed low because of investor caution and the decreased trading hours during Ramadan.