Interest Rate

The State Bank of Pakistan (SBP) has maintained its key interest rate at 22 percent for the fifth consecutive policy meeting, with the decision announced just ahead of the general elections scheduled for next week. This decision is also significant as it occurs amid the ongoing $3 billion Standby Arrangement (SBA) with the International Monetary Fund (IMF).

Speaking at a press conference in Karachi, SBP Governor Jameel Ahmad stated that the Monetary Policy Committee (MPC) had reviewed current economic developments, ultimately deciding to keep the policy rate unchanged at 22 percent. Governor Ahmad highlighted improvements in Pakistan’s external account, as reflected in the rise of foreign exchange reserves from just over $4 billion in July 2023, when the standby agreement was signed, to the current $8.3 billion, despite significant debt repayments.

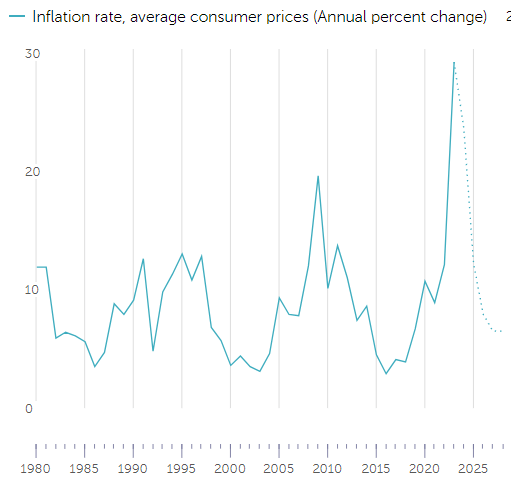

While the current account deficit showed improvement, Governor Ahmad acknowledged ongoing debt repayments and highlighted the MPC’s revision of the average inflation assessment for the fiscal year to 23-25 percent, considering elevated gas and electricity prices.

Addressing inflation, Governor Ahmad noted a declining trend since May 2023, when it peaked at 38 percent. He expressed confidence that inflation would start decreasing faster from March. The MPC also set a medium-term target to be achieved by September 2025.

Despite acknowledging improved business confidence and economic activity, particularly in industrial capacity utilization and large-scale manufacturing, the SBP governor emphasized that inflation, though falling, remains high for an immediate rate cut. The decision aligns with market consensus, with experts noting the continued challenge of inflation and external account considerations.

The next MPC meeting is scheduled for March, and the decision maintains the key interest rate at its historically high level, set in June as part of the conditions for the IMF bailout. The ongoing economic situation underscores the complex interplay of inflation, debt repayments, and external account dynamics in shaping Pakistan’s monetary policy.