Stock Market

KARACHI: The optimism fueled by an IMF-driven rally in the stock market proved short-lived as mounting political tensions unsettled investors, leading them to capitalize on gains and causing the benchmark KSE 100-share index to trim early advances. Despite this, the market managed to close in positive territory by the end of the trading session on Friday.

The positive momentum at the beginning of the trading day, resulting in an intraday high of 739 points, was attributed to the approval of the first economic review of Pakistan under the $3 billion Stand-By Arrangement by the IMF’s Executive Board. This development was expected to release a $700 million tranche. However, during the closing hours, skeptical investors opted to book profits, expressing concerns that upcoming news related to the elections might introduce volatility to the market.

Ahsan Mehanti of Arif Habib Corporation noted that the mid-session experienced selling pressure due to uncertainty surrounding the Senate resolution regarding the postponement of general elections. On the positive side, surging Pakistan dollar bonds, rising global crude prices, and a robust rupee contributed to the index closing in the green.

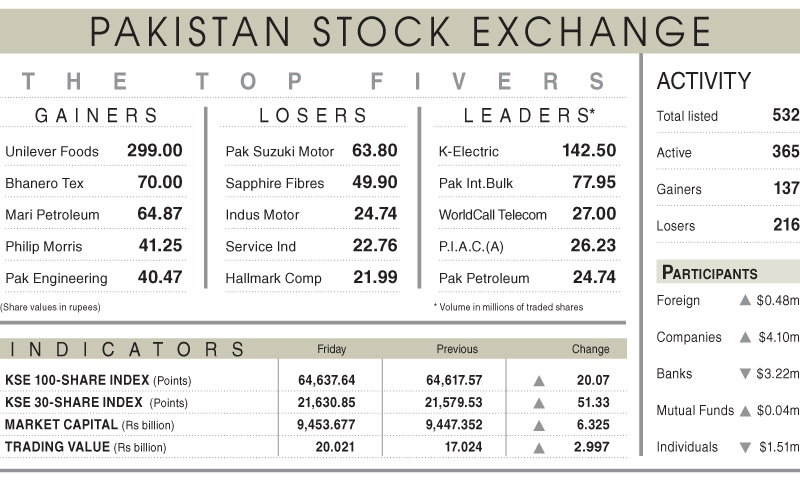

The KSE-100 index closed at 64,637.64 points, a marginal increase of 20.07 points or 0.03% from the previous session. The intraday range fluctuated between 64,491.08 and 65,356.85 points.

The overall trading volume increased by 9.67% to 643.30 million shares, while the traded value rose by 17.60% to Rs20.02 billion on a day-on-day basis. Notable stocks in terms of volume included K-Electric Ltd, Pakistan International Bulk Terminal, Worldcall Telecom Ltd, Pakistan International Airlines Corporation, and Pakistan Petroleum Ltd.

Despite fluctuations, certain companies witnessed significant increases in their share prices, such as Unilever Foods Ltd, Bhanero Textile Mills Ltd, Mari Petroleum Ltd, Philips Morris, and Pakistan Engineering Ltd. Conversely, companies experiencing notable declines included Pak Suzuki Motor Company Ltd, Sapphire Fibres Ltd, Indus Motor Ltd, Service Industries Ltd, and Hallmark Company Ltd. Foreign investors were net buyers during this period, acquiring shares worth $0.48 million.