ISLAMABAD: The Federal Board of Revenue (FBR) set a deadline of November 30, 2023, for banks to settle a 40 percent additional tax on windfall income, profits, and gains earned during the calendar years 2021 and 2022.

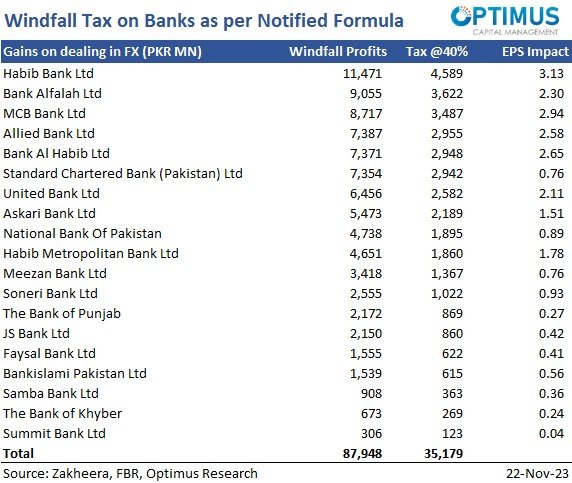

The calculation method involves deducting the current year’s profit from the average earnings of the past six years in foreign exchange (FE) accounts. This amount will be subjected to a 40 percent tax, as per the notification.

The FBR’s S.R.O.1588 (l)/ 2023 issued on Wednesday evening pertains to imposing a 40 percent additional tax on windfall profits within the banking sector, as specified under section 99D of the Income Tax Ordinance. Below is the bank-wise break-up of windfall tax payment by November 30, 2023.

According to the FRB, the notification outlines the criteria for computing windfall income, profits, and gains, specifying the 40 percent tax rate for section 99D.

It defines the scope of such income for the calendar years 2021 and 2022, corresponding to tax years 2022 and 2023 respectively.

The deadline for the payment of this additional tax, unless extended for valid reasons by the Commissioner, is November 30, 2023, or within a maximum of 15 days’ extension upon a written application from the taxpayer.

Payment of the extra tax must be made through a specified challan or computerized payment receipt in the federal treasury, as mandated by the FBR.

The calculation of windfall income, profits, and gains will follow a prescribed formula, as detailed by the FBR in the notification, along with provided illustrations (Illustration- I and II based on banks’ Foreign Exchange Income declared in Financial Statements).