ISLAMABAD: Fitch Ratings’ latest post highlights that vulnerable sovereigns may face additional fiscal, growth, inflationary, and external liquidity challenges due to environmental stresses linked with El Nino weather conditions.

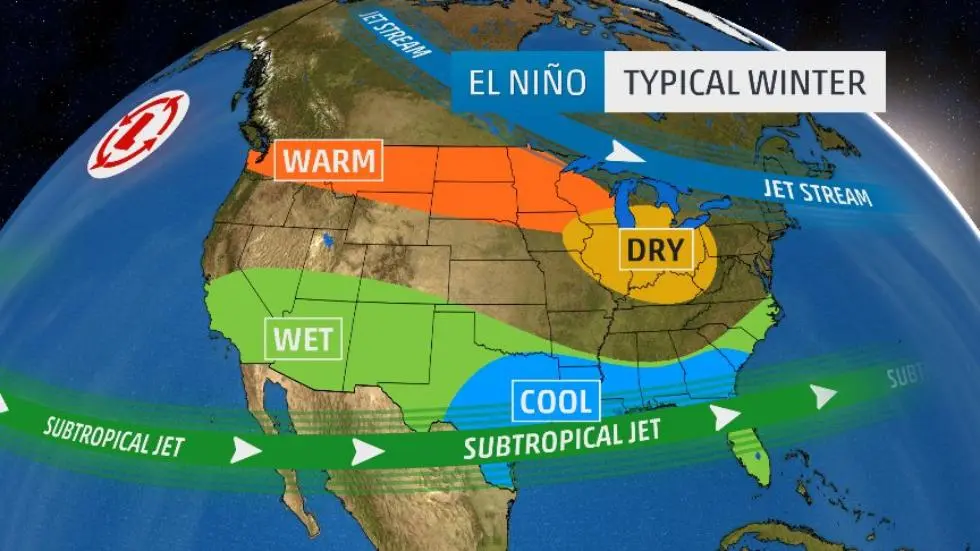

The El Nino phenomenon can cause abnormally dry conditions in some regions and above-average rainfall in others.

These adverse environmental conditions, which could dampen economic activity, have the potential to negatively impact the creditworthiness of susceptible sovereigns with limited access to financing or a history of increasing debt during crises. The reduced crop production might lead to decreased exports and increased food imports, exacerbating external liquidity stress and potentially driving up local inflation rates. The implications on hydropower output could also be economically significant.

While highly-rated sovereigns have more flexibility to mitigate the effects of adverse weather conditions, as their export sectors and economies tend to be more resilient, they might still be indirectly affected. For instance, El Nino conditions could influence global food commodity prices, influencing their inflation and monetary policy decisions. Governments may resort to subsidies or transfers to mitigate the impact of rising food prices, but this can strain their fiscal metrics. Furthermore, many governments find themselves with limited fiscal space after dealing with the COVID-19 pandemic and periods of elevated global inflation.

Nevertheless, the Food and Agriculture Organization of the United Nations anticipates global cereal production in 2023 to surpass the previous record set in 2021. If this prediction holds true, it should provide a buffer against the risk of output disruptions in 2024 and suggests that any impact from El Nino on global food prices as a whole should remain limited.

State Bank Of Pakistan Imposes Over Rs83 Million Fine On Four Banks

Meanwhile, these four financial institutions incurred a collective fine of Rs83.157 million for non-compliance with the central bank’s guidelines on foreign exchange, customer due diligence, and general banking operations.