Prime Minister Shehbaz Sharif announced the Young Business and Agricultural Loan Schemes in Islamabad, with the goal of fostering young entrepreneurship and self-employment.

Individuals between the ages of 21 and 45 are eligible for the lending facility under the programmes.

IT and e-commerce enterprises must have a minimum age of 18 years old.

PM Stated:

Loan “schemes are aimed at making the youth self-reliant”.

Finally, Here are the step-by-step instructions for applying for the loans:

Documents Required

- Pictures

- CNIC

- Latest academic degree

- Experience certificates (if applicable)

- License/registration with chamber or trade body/union (if applicable)

- Recommendation letter from respective chamber/trade body/union (mandatory in case of existing business)

Other Important Details

- National Tax Number (NTN)

- Consumer ID of electricity bill of current address (if applicable)

- Registration number of any vehicles registered in the applicant’s name (if applicable)

- Name, CNICs, and mobile numbers of two references other than blood relatives

- An estimate of monthly business income, business expenses, household expenses, and other income in case of new business and actual monthly business income, business expenses, household expenses, and other income in case of existing business

How to Apply?

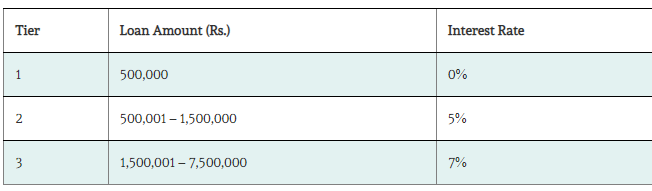

Loan Amount and Interest Rate

Moreover, Including agricultural loans will help rural youth bring innovation to farming, such as mechanised farming, the development of agricultural value chains, and the solarization of farming equipment, in order to create more sustainable energy resource management in a country like Pakistan with a challenging climate.

Small business microfinance loans would stimulate employment creation rather than job searching among the nation’s youth bulge.

Additionally, You may also employ Islamic banking services on the loan programme.

Women’s Quota is 25%.

Furthermore, the prime minister stated that loans of up to Rs. 1.5 million might be secured via programmes with the borrower’s personal guarantee.

PM Said:

“There will be no interest rate on the loan of up to Rs0.5 million.

5% interest will be charged on the loan of over Rs0.5 million to 1.5 million,”

He Continued:

“7% interest rate will be charged on the loan of over Rs1.5 million to Rs7.5 million.”

State Bank of Pakistan (SBP) Governor Jameel Ahmad stated on the occasion that:

“special instructions had been issued to the banks for issuing loans to the youth”.

The major goal of the government and the central bank, he continued, is to offer loans to the agricultural business.

Farmers in flood-affected areas will receive assistance, according to the governor of SBP.

“The maximum amount of agricultural loans has been increased by 44%.”

He requested that all institutions actively engage in the youth loan scheme.