A Karachi-based business called Neem, which provides an embedded financial wellness platform, announced on Tuesday that it has raised $2.5 million in a seed fundraising round sponsored by both international and domestic investors.

The startup estimates that the underbanked communities in Pakistan represent a $167 billion market potential, and it plans to use the new capital to expand its services to these communities.

The company claims that SparkLabs, Arif Habib Limited, Cordoba Logistics and Ventures, Taarah Ventures, My Asia VC, ConceptVines Ventures, and Building Capital led the fundraising round, the company claims.

“The worldwide embedded banking revolution is about democratization, personalization, and access to products and services at the point of encounter.

“At Neem, our goal is to offer services to consumers wherever they may be, whenever they may require them,” explained Nadeem Shaikh, one of the company’s co-founders.

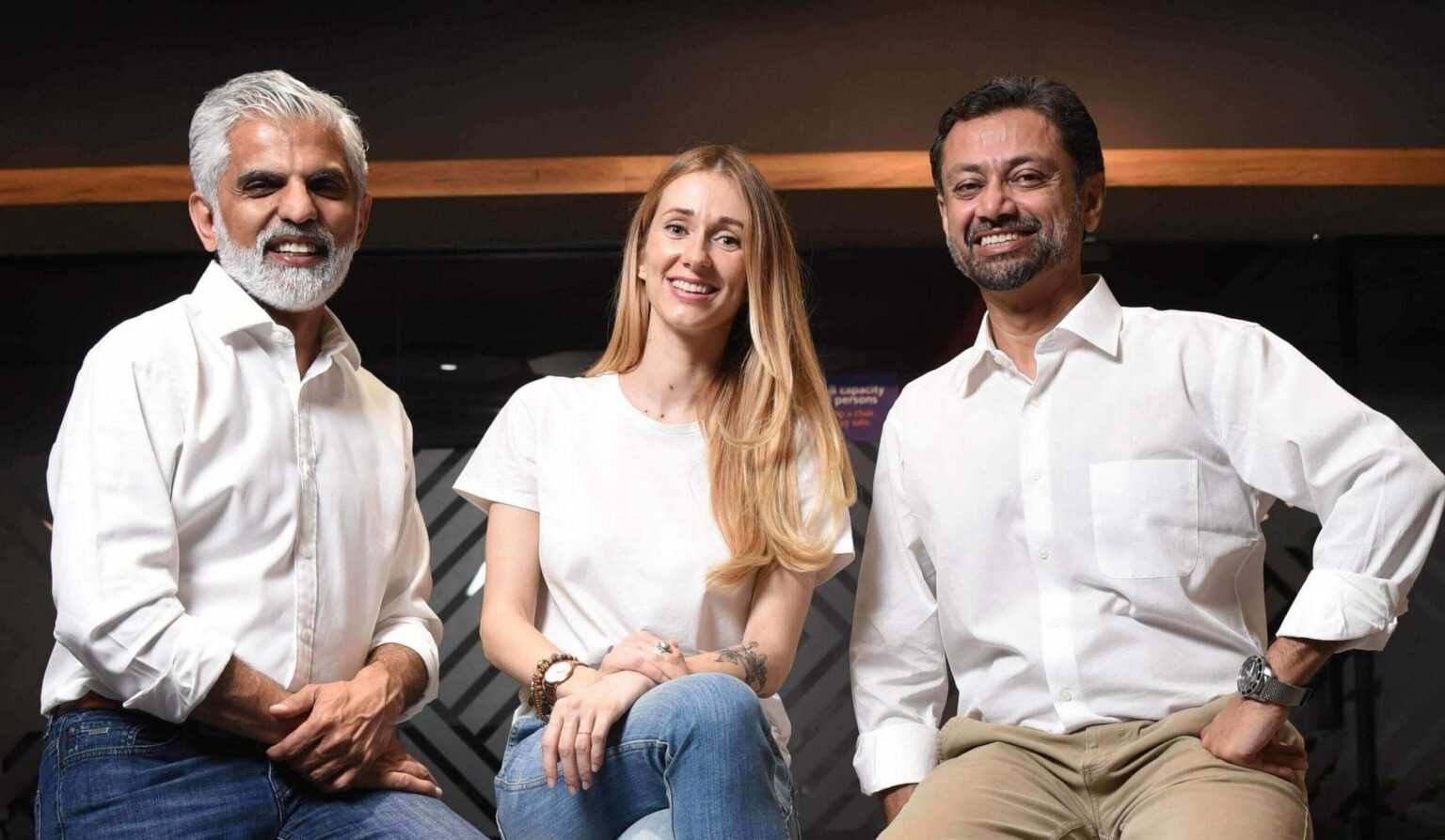

Shaikh, Vladimira Briestenska, and Naeem Zamindar founded Neem in 2019 with the idea that people and businesses need a financial platform that meets all of their demands.

An individual’s or a company’s financial well-being can be measured by the extent to which they are able to “provide themselves financial independence through savings and investments,” as stated in a statement.

Neem shared information from the State Bank of Pakistan showing that over half of Pakistan’s adult population and over three million micro, small, and medium-sized enterprises (MSMEs) are now unbanked.

In describing its integrated finance platform, the business said it provides two primary services: a Banking as a Service (BaaS) platform and a loan platform.

Neem’s BaaS platform enables partners to integrate payments and wallets into their communities and to provide insurance and savings plans tailored to the specific needs of those communities.

Neem’s lending platform, on the other hand, lets third parties offer individualized loans to consumers and small and medium-sized businesses.

The investment is part of a record year for startup funding in Pakistan. Even though the trend continued into this year, numerous businesses have already stated they will be closing.