ISLAMABAD: The International Monetary Fund (IMF) has opened a new Pandora’s Box for the government by asking for renegotiation of the China-Pakistan Economic Corridor (CPEC) energy deals before making payments of around Rs300 billion to the Chinese IPPs.

The IMF has asked the government to treat the Chinese CPEC power plants at par with the power plants established under the 1994 and 2002 power policies.

These plants had been set up under the CPEC framework agreement. The IMF’s demand came after China’s refusal in the past to renegotiate the terms of agreements with the independent power producers (IPPs), Express Tribune reported it today.

According to sources, the IMF suspects that the Chinese IPPs might have been overcharging Pakistan and there was a need to reopen these deals. The Mohammad Ali report on the IPPs had already revealed overpayment of about Rs41 billion to the Chinese IPPs.

Top officials in the Ministry of Finance confirmed to The Express Tribune that the IMF had raised the issue of payments to the Chinese IPPs with their willingness to renegotiate the deals.

According to Tribune, Esther Perez, IMF’s Resident Representative, has emphasized the need for equitable treatment of all power sector stakeholders due to the limited fiscal space.

“An important principle underpinning these (power sector) reforms is that all stakeholders contribute in an equitable manner to reduce the circular debt, between the government, IPPs and consumers, while protecting the most vulnerable consumers,” said Perez.

She said that Pakistani authorities should be cognizant of the limited fiscal space available to clear any outstanding arrears of the sector stakeholders, and thus there should be a trade-off between this and other government priorities, and the potential to unlock lower capacity payments for electricity as part of the aforementioned burden sharing across stakeholders.

Perez added that in order to contain circular debt in the power sector, the government of Pakistan had engaged efforts to reduce the cost of power generation as part of a broad power sector reform strategy, including in concluding renegotiations of the capacity payment terms with over 30 IPPs last year.

She added that a number of partners of Pakistan were supporting those reforms, including the World Bank and the IMF.

Sources said that the global lender had also objected to giving Rs50 billion to the Chinese IPPs in February this year without first renegotiating the agreements.

Due to the IMF’s objections, the government did not directly make payment of Rs50 billion to the Chinese IPPs last week. Instead, the government released Rs50 billion for the Power Division under the general subsidy claims for July. In return, the Power Division made the payment to the Chinese IPPs and some others to address their liquidity crunch.

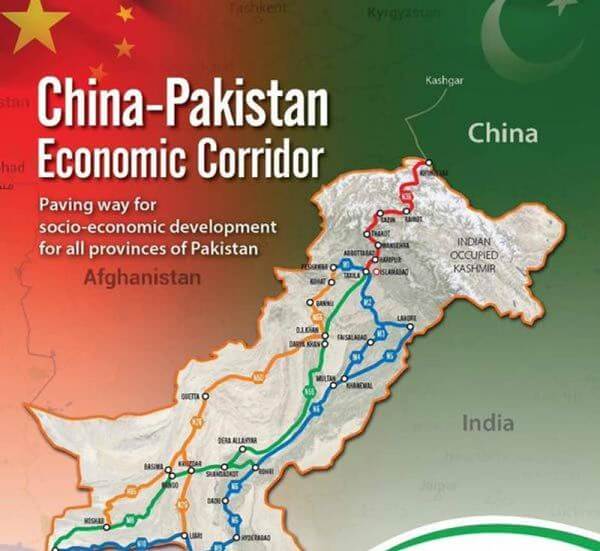

So far, 11 Chinese IPPs, set up with an investment of $10.2 billion, are operational, having total generation capacity of 5,320 megawatts. Out of these, nearly 2,000MW of power plants had been shut last month due to the depletion of imported coal inventories.

As of May 13, Pakistan owed Rs340 billion to these power plants, out of which the government has now indirectly cleared some of the dues, leaving behind around Rs300 billion. The Chinese IPPs had threatened to stop their plants if the payments were not immediately cleared, prompting the prime minister to convene a meeting to address their concerns.

Six more Chinese IPPs, being set up with an investment of $6.8 billion, are at various stages of implementation and will add 3,584MW to the generation capacity of Pakistan.

The previous government had renegotiated the power purchase and implementation agreements with the 46 IPPs established under the 1994 and 2002 power policies. The renegotiation is expected to save Rs770 billion over a period of 20 years.

The government had won concessions on account of reduction in the return on equity and other cost saving benefits from the power plants of 1994 and 2002 policies. In return, the government agreed to pay Rs403 billion to them in two installments.