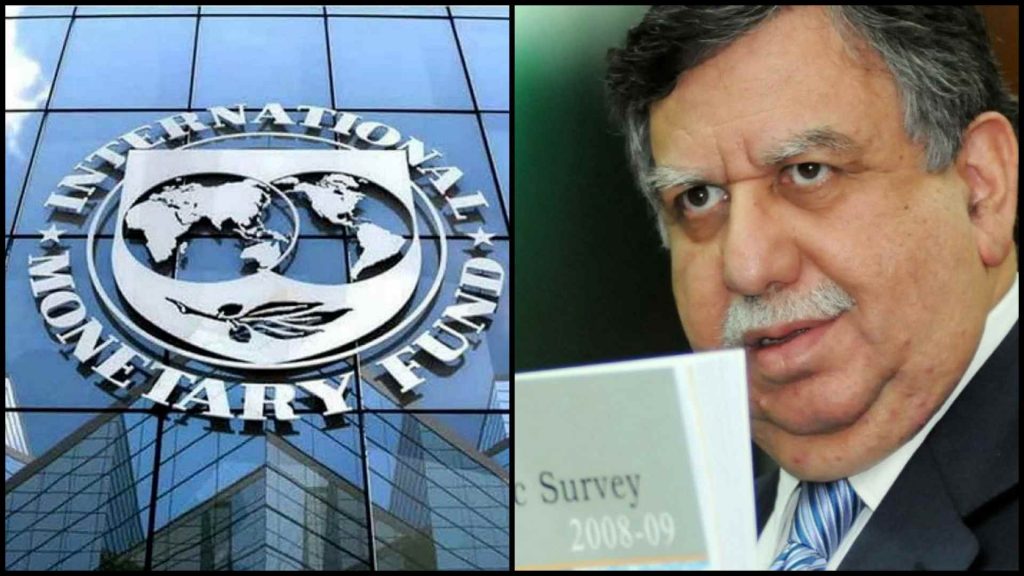

ISLAMABAD: Shaukat Tarin, Prime Minister’s Adviser said that IMF has given a list of five major prior actions to Pakistan for the resumption of its $6 billion Extended Fund Facility (EFF).

Tarin told media five prior actions include abolition of tax exemptions/Tax Exemption bill 2021, approval/enforcement of State Bank of Pakistan (SBP) Amendment bill 2021, and already raised electricity tariff, which are in addition to two other minor actions.

He further said the IMF asked for getting approval of the SBP’s Amendment bill, nonetheless, it would be submitted before the parliament in line with the agreement with the IMF, he added.

Adviser to PM said that the IMF did not agree with the promulgation of the ordinance for withdrawal of tax exemptions and said the government would have to submit a tax exemption bill in order to fulfil the IMF’s conditions.

Senior officials said that the increase in monetary policy ranging from 75 to 100 basis points, adjusting upward from 7.25 to 8 or 8.25% and adjustment in the exchange rate, will also be part of prior actions for completion of the outstanding Sixth Review under the IMF programme. Now the SBP has convened its Monetary Policy Committee (MPC) on Friday (November 19) instead of November 26, 2021, for considering the monetary stance according to IMF requirement.

Analysts believe that it will be challenging for the government to pass a fresh finance bill in the shape of Tax Exemption Bill 2021 from the National Assembly. Recently, the government had faced defeat on two bills but in case of defeat on the Finance Bill in the National Assembly, it could result in the ending of the PTI-led regime.

“Soon after accomplishing implementation on five prior actions, the IMF’s staff-level agreement would be done. The five prior actions included the Tax Exemptions bill, SBP Amendment Bill, and already hiked power tariff. There are two other minor actions as well. It is hoped that all five prior actions would get implemented and then the IMF’s deal would be done,” Adviser to Prime Minister on Finance Shaukat Tarin said.

He said that the government shared with the IMF the Circular Debt Management Plan (CDMP) as circular debt would be slashed down by Rs300 to 400 billion. He said that the companies did not announce their dividends, so the government made up plans to utilize the dividend amount of six to seven giants of public sector companies to be utilized to pay off the circular debt.