Leaders of the world’s 20 biggest economies have endorsed a global minimum tax of 15 percent on big multinational businesses.

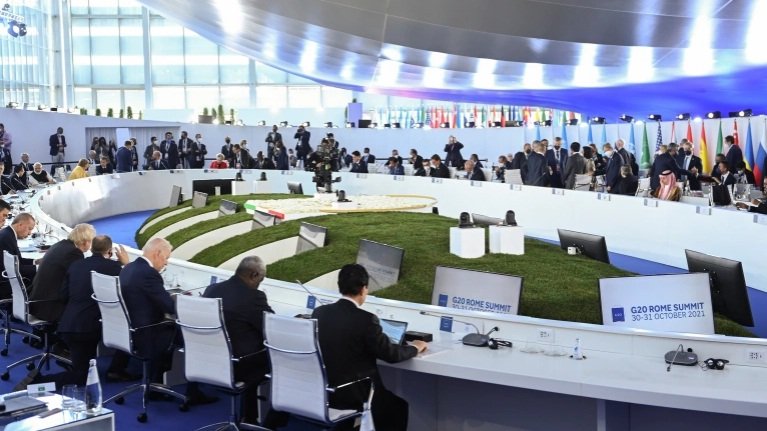

They have formally adopted the new rules at the ongoing G20 summit in Rome on Sunday.

Joe Biden, the president of the United States who is in the Italian capital for the discussions, hailed the tax deal as a “game-changer”.

“Here at the G20, leaders representing 80% of the world’s GDP – allies and competitors alike – made clear their support for a strong global minimum tax,” Biden said in a tweet on Saturday.

“This is more than just a tax deal – it’s diplomacy reshaping our global economy and delivering for our people.”

The tax rules, part of a reform plan inked by almost 140 nations, will make it harder for multinational corporations – including giants like Google, Amazon, Facebook, Microsoft or Apple – from avoiding taxation by establishing offices in low-tax jurisdictions.

The rules will also aim to put an end to decades of tax competition between governments to attract foreign investment.

US Treasury Secretary Janet Yellen hailed the G-20’s endorsement of the tax deal as “historic” while German Chancellor Angela Merkel called it a “great success”.

“There are good things to report here,” Merkel told reporters on Saturday. “The world community has agreed on a minimum taxation of companies. That is a clear signal of justice in times of digitalisation.”

The Reuters news agency, citing a draft communique, said the G20 wants to have the rules in force in 2023.

The Organisation for Economic Cooperation and Development (OECD), which steered the tax negotiations, estimates the minimum tax will generate $150bn in additional global tax revenues annually.

It says taxing rights on more than $125bn of profit will also be shifted to the countries where they are earned from the low tax countries where they are currently booked.

Mathias Cormann, secretary-general of the OECD, said that the deal clinched in Rome “will make our international tax arrangements fairer and work better in a digitalised and globalised economy”.

The minimum rate “completely eliminates the incentive for businesses around the world to restructure their affairs to avoid tax,” he said, contending that this will also “deliver significant benefits to countries around the world including and in particular developing countries”.

But Civil 20, which represents some 560 organizations from more than 100 countries in a network making recommendations to the G-20, was less enthusiastic.

The 15 percent rate is “a little more than those (rates) we’d consider fiscal paradises,” Civil 20 official Riccardo Moro told reporters.