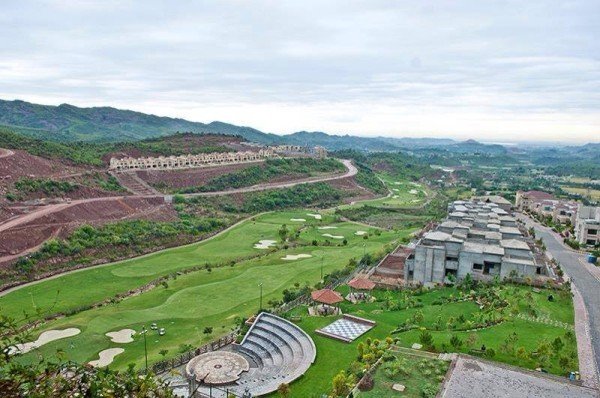

The Federal Board of Revenue (FBR) will auction 527 kanals and 10 marlas of Bahria Town land in Murree to recover unpaid taxes. The government aims to collect Rs26 billion from the developer. Authorities scheduled the auction for February 16 under strict enforcement proceedings.

Recently, the FBR intensified its actions against defaulters. For example, it auctioned a Bahria Town plot on Park Road, Islamabad, raising Rs2.05 billion for the national exchequer. In addition, last week, the FBR announced it will auction Bahria Town Tower in Karachi. These steps show that the tax authority targets major defaulters across multiple cities.

Auction Details and Restrictions

Officials said the Murree property includes 527 kanals and 10 marlas. Furthermore, the FBR warned that buyers cannot sell, transfer, or purchase Bahria Town’s seized properties in Karachi without prior approval. Consequently, anyone who completes a transaction without consent will face legal consequences.

In addition, the FBR told citizens to submit objections or claims regarding seized properties to the Large Taxpayer Office in Islamabad. The office will review all claims based on current tax laws. Officials emphasized that they will continue enforcing tax laws until the authority recovers all dues.

FBR’s Strategy to Tackle Tax Evasion

The recent auctions reflect the FBR’s focused strategy to stop tax evasion by large developers. By targeting high-value properties, the authority recovers billions for the national exchequer. Moreover, officials said these measures send a clear message: companies of any size must meet their tax obligations.

Additionally, the government strengthens revenue collection through these actions. Analysts noted that property auctions not only recover dues but also promote transparency in real estate transactions. The FBR linked multiple Bahria Town properties in Islamabad, Karachi, and Murree to tax arrears. This approach shows a coordinated effort to enforce tax laws across the country.

Authorities confirmed that the Murree auction will take place publicly and follow legal procedures. Therefore, interested buyers must follow all regulations and obtain prior approval for any transaction. The FBR also stated that it will transfer all auction proceeds to the national exchequer to support government spending.

Overall, the FBR demonstrates strong determination to recover billions in taxes. As a result, the government holds major developers accountable. Furthermore, citizens and investors must follow updates and comply with legal rules to avoid disputes.