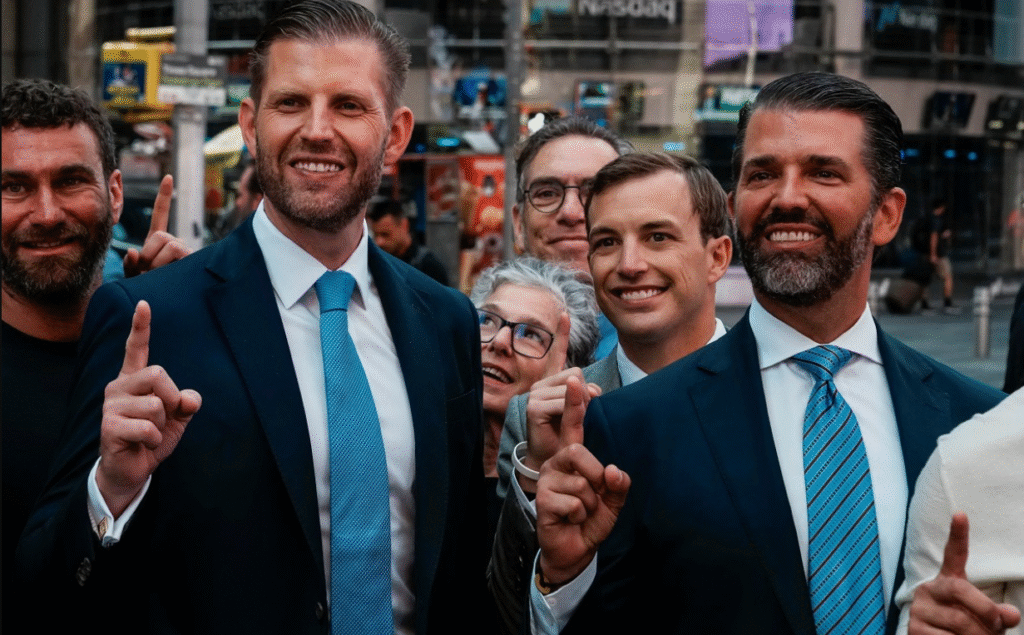

American Bitcoin, a cryptocurrency mining company backed by Donald Trump Jr. and Eric Trump, is preparing to begin trading on the Nasdaq this September. The firm is finalizing an all-stock merger with Gryphon Digital Mining, positioning itself to emerge as a major player in the global bitcoin sector.

Merger With Gryphon Digital Mining

The merger with Gryphon Digital Mining will allow American Bitcoin to go public without pursuing a traditional IPO. Instead, the combined entity will retain the name American Bitcoin and trade under the ticker symbol ABTC.

According to its largest investor, Hut 8, the process is nearly complete, and anchor shareholders for the listing have already been secured. Hut 8, a company that previously focused on crypto mining but now operates in energy infrastructure and data centers, owns an 80 percent stake in American Bitcoin.

Once the merger is finalized, Eric Trump, Donald Trump Jr., and Hut 8 will jointly control approximately 98 percent of the new entity.

Advantages of the Merger Approach

Company executives believe that merging with an existing firm provides more financing flexibility compared to a direct public offering. By leveraging Gryphon Digital Mining’s existing access to financing channels, American Bitcoin can expand more aggressively in both domestic and international markets.

Expansion Plans in Asia

Eric Trump has been active in promoting the company’s international presence. Currently in Hong Kong, he is scheduled to visit Tokyo for an event hosted by Metaplanet, a Japanese bitcoin treasury firm.

American Bitcoin is actively exploring opportunities to acquire crypto assets in Hong Kong and Japan. These acquisitions are expected to strengthen its global business and provide greater exposure to digital asset markets outside the United States.

As part of its growth strategy, the company may also consider taking stakes in firms abroad. This would give investors in different regions access to publicly listed bitcoin assets, especially those unable to purchase Nasdaq-listed stocks.

Early Stages of Growth

Although expansion plans are underway, the company remains in the early stages of development. Executives have stated that no binding commitments have been made regarding specific acquisitions. However, the intention to expand internationally highlights the company’s ambition to establish itself as a global leader in digital assets.

Shift in Strategy by Hut 8

Hut 8, once a well-known crypto mining firm, has pivoted its focus toward energy infrastructure and data centers. Its role in launching American Bitcoin with the Trump brothers reflects a broader strategy of aligning cryptocurrency mining with scalable infrastructure solutions.

The upcoming Nasdaq listing represents a significant milestone for American Bitcoin. With strong backing from Trump’s sons and experienced investors, the company is well-positioned to attract global attention. The move also signals increasing mainstream acceptance of cryptocurrency-related companies in U.S. financial markets.

As it prepares for trading in September, American Bitcoin’s merger-driven approach and expansion plans suggest that the company aims to grow beyond mining into a diversified digital asset enterprise. Its presence in Asian markets, combined with strong U.S. political and financial connections, could shape its role in the next phase of global cryptocurrency adoption.