Nvidia has once again surpassed Wall Street expectations in its second-quarter earnings for 2025. The company reported strong revenue and earnings, yet its shares dipped in extended trading. Concerns around data center performance and uncertainty regarding chip sales to China weighed heavily on investor sentiment. Despite these challenges, Nvidia continues to lead the AI race, projecting trillions in future infrastructure spending and unveiling next-generation innovations.

1. H20 Chip Shipments to China Remain Unclear

Nvidia confirmed that no H20 chips have been shipped to China this quarter. While some customers have received licenses, strict restrictions have slowed deliveries. Shipments worth $2 billion to $5 billion could be realized if conditions ease, but the company excluded this revenue from its Q3 forecast.

CEO Jensen Huang emphasized that China is vital for American technology companies. He highlighted the country’s importance as the world’s second-largest computing market and the home of nearly half of global AI researchers.

Despite these challenges, analysts noted that Nvidia’s strong gross margin guidance of 73.5% demonstrates profitability resilience even without Chinese revenue.

2. Tepid Sales Outlook Despite Strong Forecast

Nvidia projects third-quarter revenue of $54 billion, slightly above analyst expectations of $53.4 billion. However, the outlook excludes potential H20 shipments to China.

The company also announced an additional $60 billion in stock buybacks, signaling confidence in long-term growth. Still, some investors expressed concern that revenue growth has slowed compared to last year’s extraordinary triple-digit expansion. Growth of 50–55% now feels modest compared to the previous 100% surge.

3. Trillions Expected in AI Infrastructure Spending

Looking toward 2030, Nvidia projects global AI infrastructure spending to reach between $3 trillion and $4 trillion. Executives described this as a massive long-term growth opportunity.

This forecast comes as major technology companies increase capital expenditures on AI, fueling global economic growth. Analysts believe strong AI fundamentals remain intact, supported by heavy hyperscale and cloud investment.

Although some industry leaders caution that AI markets may be overhyped, Nvidia’s outlook reflects confidence in sustained demand.

4. Robotics Emerges as a New Growth Driver

After years of growth powered by AI model development, robotics is now becoming a significant opportunity. Nvidia’s new Jetson AGX Thor platform—dubbed a “robot brain”—is gaining momentum with more than 2 million developers adopting it.

Executives highlighted that robotics requires vastly greater computing power, both on-device and in supporting infrastructure. This creates a strong demand driver for Nvidia’s data center business.

In addition, automotive revenue rose 69% year-over-year, reaching $586 million, largely due to advances in self-driving technologies.

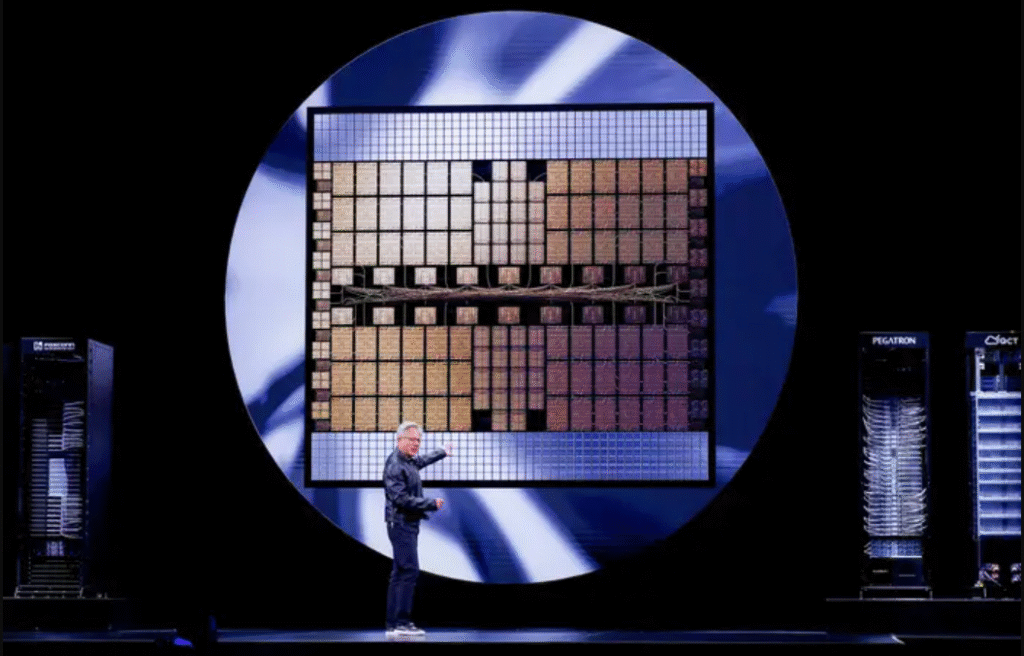

5. Next-Generation Rubin Chips On Track

Nvidia confirmed that its Rubin chips, the successor to the Blackwell architecture, are already in the manufacturing stage and will enter volume production in 2026.

The company stressed that this product cycle aligns with its annual cadence of innovations in compute, networking, systems, and software. Rubin is expected to provide a predictable revenue stream while reinforcing Nvidia’s leadership in the semiconductor industry.

Conclusion

Nvidia’s second-quarter results highlight both strength and uncertainty. Revenue exceeded forecasts, margins remain strong, and long-term growth drivers—AI, robotics, and next-generation chips—are firmly in place. However, uncertainty around China shipments and slowing growth momentum created caution among investors.

Even with these challenges, Nvidia’s position at the center of the global AI race remains unshaken. The company continues to define the future of advanced computing and is betting on robotics and AI infrastructure to power growth into the next decade.