Border Tensions

Indian shares experienced a significant downturn for the second consecutive session, with market values plummeting by approximately $83 billion as heightened military tensions between India and Pakistan unsettled investors. The ongoing conflict, which began earlier in the week, has contributed to the sharp decline in market confidence.

The situation between the two nuclear-armed neighbors has been increasingly tense since Wednesday, when India launched strikes on several “terrorist infrastructure” sites in Pakistan. This action came in retaliation for a deadly attack in Indian-administered Kashmir last month.

In response, Pakistan retaliated, leading to a series of cross-border exchanges of military action, further escalating the conflict. The continuing volatility has rattled both domestic and international markets, causing investors to become wary of further escalations.

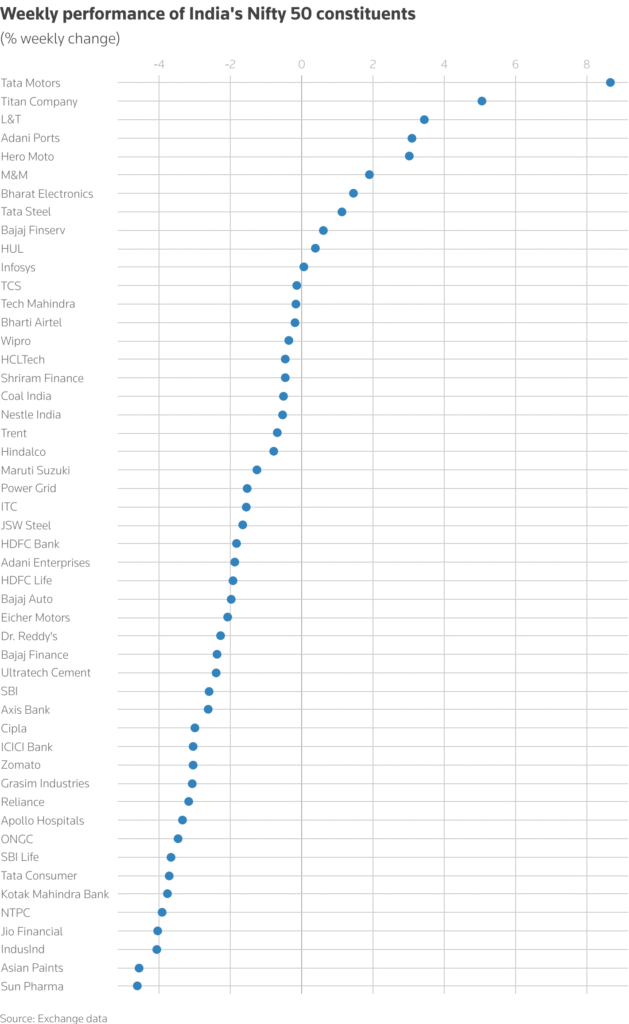

On Friday, India’s Nifty 50 index fell by 1.1%, though it managed to stay above the critical 24,000-point mark. Similarly, the BSE Sensex also lost 1.1% and closed below the 80,000-point threshold it had held the previous day.

At the height of the market’s fall, the loss in market value had reached a staggering $108 billion, reflecting the deepening anxiety among traders. The Nifty 50 index, in particular, snapped its longest winning streak of the year, marking the end of a three-week upward trend.

The stock market’s decline was driven primarily by the heightened tensions at the border, with many investors fearing that Pakistan’s potential retaliatory measures could escalate into a prolonged, full-scale conflict.

As Avinash Gorakshaka, head of research at Profitmart Securities, noted, the domestic market is now more focused on sentiment driven by news of the conflict rather than economic fundamentals, causing significant volatility in the short term.

Additionally, the volatility index (VIX), often referred to as the “fear gauge,” spiked for the eighth consecutive session, reaching its highest point in more than a month. This signaled increasing investor anxiety and uncertainty in the face of the escalating situation.

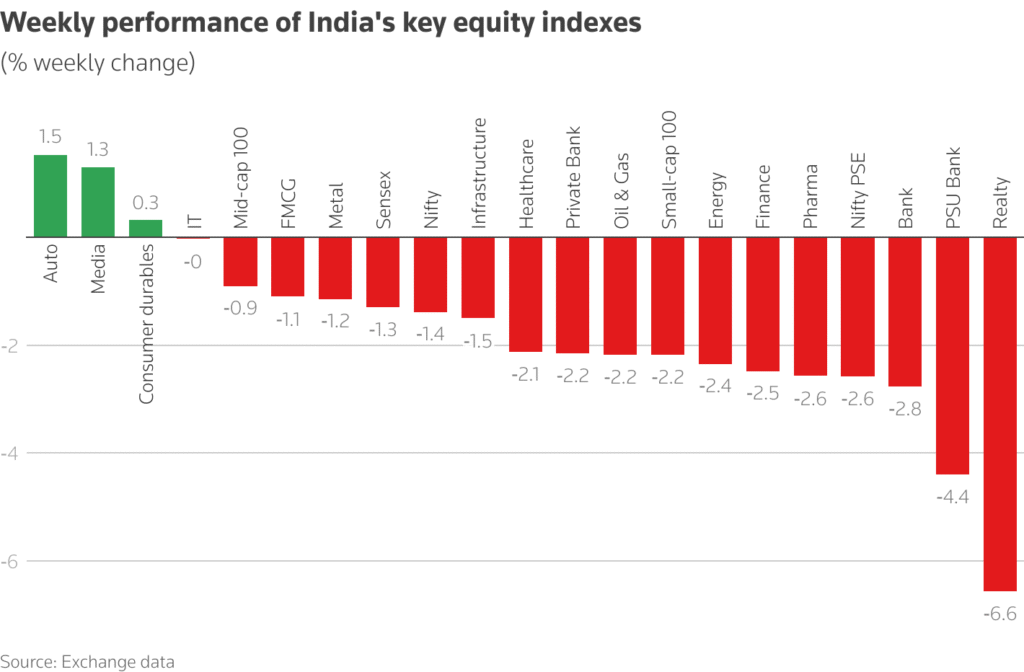

The central bank also had to step in to curb the decline of the Indian rupee, which had been impacted by the tense political climate and market jitters. Across the broader market, 12 of the 13 major sectors saw losses, while small-cap and mid-cap stocks dropped by 1.9% and 0.8%, respectively.

The only exception to the downturn was the auto sector, driven by a notable 8.7% increase in Tata Motors’ stock, fueled by optimism surrounding a potential US-UK trade deal that could benefit its British unit, Jaguar Land Rover (JLR).

Despite the current volatility, analysts remain hopeful that India’s economic resilience and potential trade deals, particularly with the United States, could offer some stability and keep traders engaged in the market.

However, the uncertainty created by the escalating conflict suggests that market momentum may remain hindered in the near term.